Oil price dropped to below $60 a barrel in the early hours of Tuesday, as trade tension between the U.S and China intensifies. This is the first time Brent oil price would inch down below $60 since January 2019.

Specifically, Brent Crude oil price has continued its free fall in recent days and it has finally fallen below $60, as it traded at $59.79 per barrel. Also, the West Texas Intermediate (WTI) was down 24 cents, or 0.4%, at $55.42 a barrel.

Trade tension dips oil price: The latest drop in oil price is due to concerns about weaker crude demand after U.S. President Donald Trump disclosed he would impose tariffs on more Chinese imports, which is potentially ramping up a trade war between the world’s two largest economies.

- Earlier on, investors’ sentiment in the global oil market slightly improved when President Trump and his counterpart, President Xi Jinping, agreed to restart the trade talks when the two world leaders met at the G-20 summit in Osaka, Western Japan.

- While briefing reporters, Trump revealed that even though the U.S does not plan to lift existing import tariffs, the North American country would refrain from slapping new levies on an additional $300 billion worth of Chinese goods.

- However, the recent drop in oil price came after Trump announced that he would impose a 10% tariff on $300 billion of Chinese imports while further threatening to raise duties if the President of China, Xi Jinping, failed to move more quickly towards a trade deal.

- China has also pledged to impose new “necessary countermeasures” to protect its interests after the latest tariff threat and oil price is quickly responding.

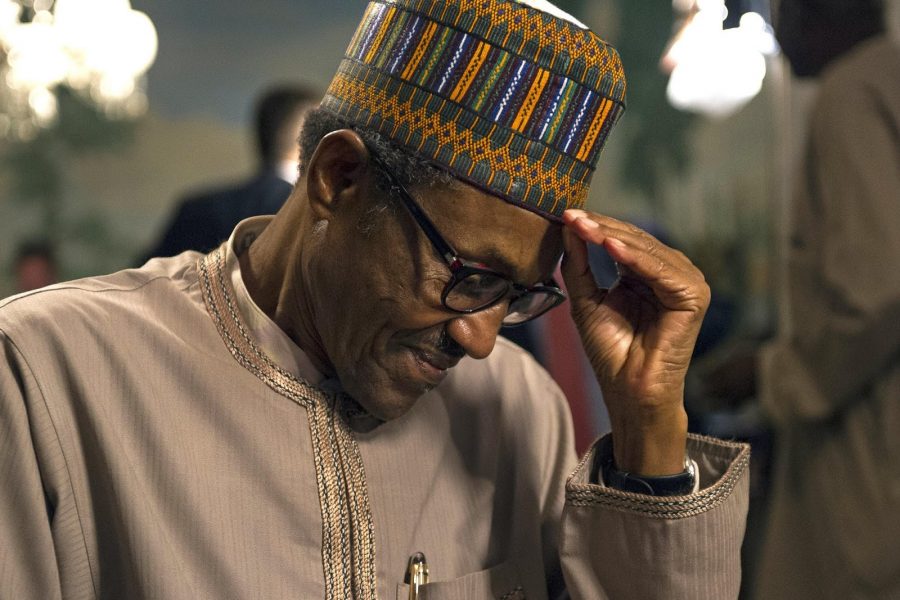

[READ: President Buhari signs N8.91 trillion 2019 budget into law]

Nigeria’s budget benchmark: The sharp drop in oil price may threaten the implementation of Nigeria’s 2019 budget. Recall that President Buhari signed the N8.83 trillion budget for the 2019 fiscal year with an assumption that oil price would remain $60.

Essentially, the 2019 budget was benchmarked at $60 just as Brent Crude in October 2018 climbed to a record high of $86.74 per barrel. However, the recent dip in oil prices suggests that critical times are ahead.

- That experts have called for a downward review of the budget benchmark means Nigeria would have to borrow to fund the revenue shortfall.

- Nigeria’s debt currently stands at N24.9 trillion and analysts have predicted N30 trillion debt by the end of 2019.

- Nairametrics also revealed that Nigeria spent a whooping N293 billion to service external debt only in half-year 2019.

[READ: Nigeria paid N293 billion to service external debt in half-year 2019]

Another development is being mooted that oil prices could drop to as low as $20 and $30 a barrel as industry experts anticipate the U.S-China trade war to further escalates.

- Goldman Sachs, as reported by Reuters revealed that Oil demand has disappointed in 2019 due to weaker economic activities, unfavourable weather and trade tensions.

- Following the escalating global trade tension, a $20 to $30 oil price means Nigeria would devalue the naira.

- The CBN Governor, Godwin Emefiele recently disclosed that the CBN would devalue the naira if the oil price falls to that region. This may nosedive the Nigerian economy into another recession.

[READ FURTHER: This is when I will devalue the naira – Emefiele]