The downturn in the stock market has shown no signs of abating, as stocks across various sectors hit 52–week lows, or multi–year lows.

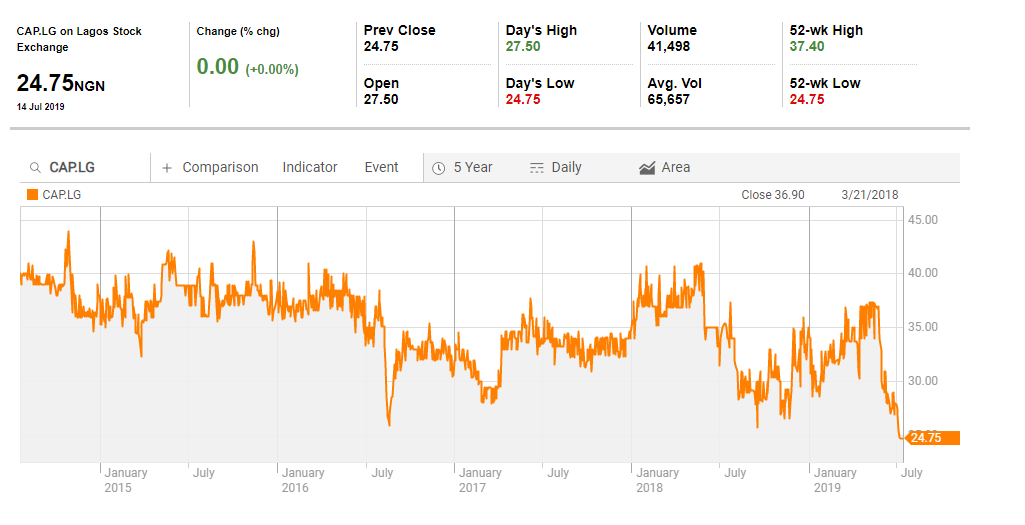

Chemical and Allied Products (CAP) Plc has been no exception. It hit a new low in yesterday’s trading session on the Nigerian Stock Exchange (NSE).

The stock opened at N27.50 and closed at N24.75, down N2.75 or 10%. Year to date, the stock is down 29%, underperforming the NSE All Share Index which is down 10.28% year to date.

The cause

The decline in the company’s share price is largely due to the negative sentiments in the entire market. Several stocks are either trading at 52 week lows or multi year lows. Investors have choosen to stay on the sidelines, till there is a clear macroeconomic direction.

Q1 2019 numbers

The company’s results for the first quarter ended March 2019, show marginal, but positive increase in both topline and bottom-line.

Revenue for the first quarter ended March 2019 increased by 8% from N1.9 billion in 2018 to N2.1 billion in 2019. Profit before tax rose from N679 million in 2018 to N733 million in 2019, also up by 8%. Profit after tax also rose from N462 million in 2018 to N498 million in 2019, appreciating by 8%.

Price movement from here

An appreciation or further decline in the stock’s price would be dependent on two factors: performance of the market as a whole, and the company’s half year 2019 results.

Barring any key macroeconomic news such as the appointment of ministers by President Muhammadu Buhari, the market is unlikely to show any significant upside anytime soon.

CAP Plc’s board is billed to meet next week to consider the company’s half year results. If the results are positive, the stock could trade within its current range, or witness negligible decline. If the performance is as uninspiring as the first quarter, new lows may be close by.

About the company

Chemical and Allied Products (CAP) Plc, a subsidiary of UAC of Nigeria (UACN) Plc, is into the manufacturing of paint and protective coatings.

The company was established originally as ICI investments limited in 1957, but later became ICI Nigeria Limited in 1965.

Following the promulgation of the Indigenization Decree in 1972 and 1977, ICI Nigeria Limited sold 40%, and then 60% of the company to the Nigerian public and changed its name to Chemical and Allied Products Limited.

In 1992, ICI Nigeria Limited finally disposed of its minority 40% shareholding in CAP Plc, when it sold 35.7% of its equity to UAC of Nigeria Plc and the rest to the Nigerian public on the floor of the Nigeria Stock Exchange (NSE). Currently, UAC of Nigeria Plc holds about 50.09% of the company’s issued share capital.