Investing is a very important part of our lives but it is always considered to be ‘too complicated’ or ‘too technical’. This is coupled with the fact that the average Nigerian does not have access to personal finance and wealth management services as he is either unserved or grossly underserved. Traditional financial institutions have made saving money and growing wealth costly and unattractive to individuals who are outside their target High Networth bracket.

Historically, people have also found it difficult to save and plan their personal finances with traditional bank savings accounts; they thus lose out on the opportunity to build the foundation for a secure financial future.

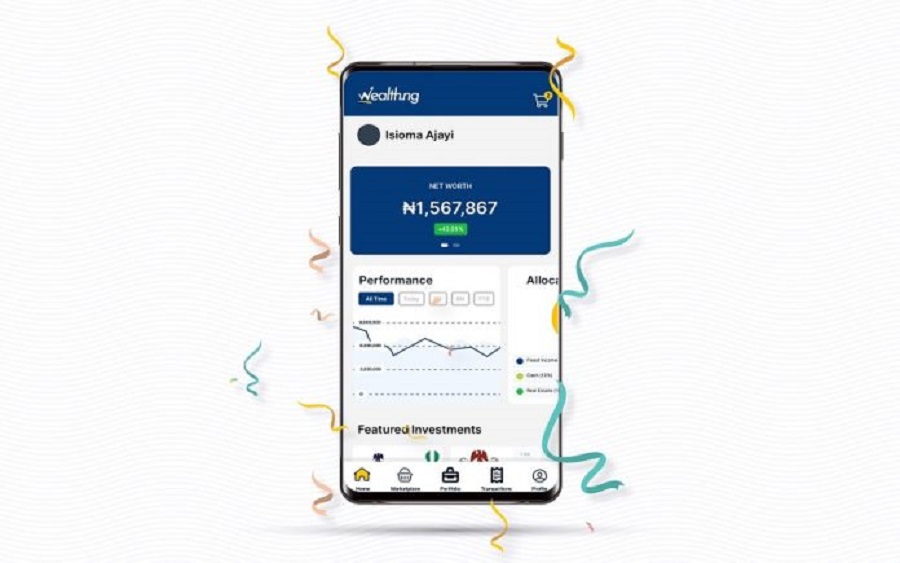

Recognizing this major issue and having a desire to bridge this gap led to the birth of Wealth.ng – Nigeria’s first investment marketplace. The platform offers investments in various asset classes such as Treasury Bills, Stocks listed on the Nigerian Stock Exchange and Agric-Finance Products.

Real Estate Products and Stocks listed on other exchanges outside Nigeria are coming soon. Wealth.ng boasts of having revolutionized the process of investing in Nigeria; making investing open to everyone – those new to investing and savvy investors.

First Impressions

A quick tour of the investment platform revealed Treasury Bills with different tenures starting from 30 days, 60 days, all the way to 365 days with a minimum investment of N10,000. Stocks of top companies on the Nigerian Stock Exchange were listed and it took just about 5 minutes to buy stocks.

A wider range of Agric-Finance products would have been preferable but the ones that were available had attractive interest rates of up to 20%. Overall, it took just about 5 minutes to sign up and get access to the myriad of investment opportunities.

How does the money part work?

The process of funding your wallet was pleasantly seamless. There are multiple options for adding money to your wallet or paying for an investment. This can be done using debit/credit cards or through bank transfer. The bank transfer process is a slightly longer route as you have to send the reference code generated for your bank transfer payment to hello@wealth.ng for your transaction to be confirmed and your wallet credited.

Another surprise followed when it was time to liquidate investments. It took less than 24 hours for the funds to get credited directly into the registered bank account and the principal and interest were both paid at maturity.

The verdict?

A confirmation that the platform is indeed a marketplace for investments.

Can this new investment platform be trusted?

Notably, in just under a few years, Nigeria has spawned many successful fintech start-ups, a trend observable across the African continent with millions of USD invested in these start-ups. Within this category, fintech services & investment products, are getting more attention. Fintech essentially leverages technology to help people save and invest, often with smaller amounts than is possible on traditional platforms.

As fintechs grow in influence and importance, one of the most notable companies to key into this sector is Sankore investments. The investment company ultimately believes in Financial Inclusion and this is expressed in the technology products developed by one of their subsidiaries – Wealth Tech Limited. Wealth Tech Limited, a subsidiary of Sankore Investments has a number of products among which is Wealth.ng.

Founded in 2010, Sankore Investments is a wealth management firm that provides advisory, brokerage, fund management and other investment services to a range of clients including individuals and corporations. Their mission is to help clients build, manage and preserve their wealth and they do this primarily by providing a bouquet of investment services tailored to the individual needs of each client.

The company is licensed by the Nigerian Securities and Exchange Commission (SEC) and hold the following SEC registrations across their business units: Investment Adviser, Portfolio Manager, Fund Manager, Broker/Dealer, Registrar, Issuing House and Trustee.

Thanks for the detailed review. Please a quick question are all fintech companies like this one and piggyvest required to register with SEC?

Interesting and brilliant. Is this a sponsored post?

Thanks for this information. I was a bit skeptical when i first heard of this investment platform. But this information has given me the motivation to make more research about wealth.ng.