Welcome to Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and Bonds. This is brought to you by Zedcrest.

This report is dated July 8th, 2019.

***Banks record ₦1.5tr non-performing loans in 2018***

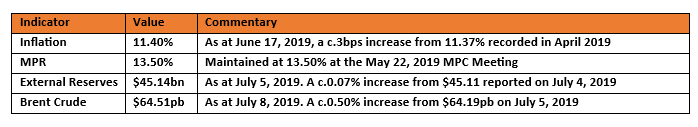

Key Indicators

Bonds: The FGN Bond market remained bullish with yields lower by c.7bps on the day, following continued demand interests across the short to mid-end of the curve.

We expect demand interests to persist but on a less aggressive tone over the course of the week.

Treasury Bills: The T-bills market was scantily traded, despite the significantly robust system liquidity levels. This was due to the lower appetite for T-bills, given the lower rates on offer in the secondary market. Yields were consequently marginally higher by c.2bps on the day.

We expect the lackluster demand interests to persist in the near term, as market players anticipate a renewed OMO supply by the CBN.

Money Market: Rates in the money market remained relatively stable as system liquidity remained significantly robust at c.N400bn est., despite the wholesale SMIS by the CBN. The OBB and OVN rates consequently ended the session at 3.36% and 4.07% respectively.

We expect rates to remain relatively stable in the near term, due to the robust system liquidity levels. This is, however, barring a renewed OMO sale by the CBN.

[READ THIS: REVEALED: Why TSTV is committed to implementing ‘Pay As You Watch’]

FX Market: At the interbank, the Naira/USD rate increased by 5k to N307.00/$ at the spot market, while the SMIS rate declined by 1k to N357.52/$. The NAFEX rate at the I&E window rose further by 7k to N360.89/, while the cash and transfer rates at the parallel market remained stable at N358.50/$ and N362.50/$ respectively.

Eurobonds: The NIGERIA Sovereigns weakened further in today’s session, with yields trending higher by c.5bps on the day.

Demand interests remained robust on the NIGERIA Corps, with the most gains witnessed on the Zenith 22s, whilst other tickers remained fully bid during the session.

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

[KEEP READING: Why foreign investors have a foothold in the Nigerian Stock Exchange]