In 2004, the Federal Government passed the Pension Reform Act. It was an act that changed how occupational benefits were designed and offered to employees by employers.

Before the passage of the Pension Reform Act, employers were solely responsible for occupational pensions and made a “Defined Benefit” promise to their employees. They promised to pay to employees a defined monetary sum as a pension. This final defined sum was typically calculated by how long an employee had worked and what was earned at retirement.

The new Contributory Pension Scheme is very different. This is because the responsibility of the employer is scaled back. The Employer is no longer required to provide a defined predetermined benefit, but simply to make a contribution to an account opened in the name of the employees.

Defined Benefit to Defined Contribution

The pension system changed from being a defined benefit to a defined contribution scheme. As a result, the only expectation of an employer is to contribute to the account of his employee. The amount the employee will receive upon retirement is now a function of the compounded investment returns delivered by the asset manager called a Pension Fund Administrator.

[Read Also: NSE lifts suspension on Royal Exchange]

The Retirement Savings Account

The key difference between both schemes has been the introduction of Retirement Savings Accounts. This is typically opened in the personal name of the employee, aka the contributor. Every contributor in the pension scheme buys units in Mutual Funds created by the Pension Fund Administrators and as such, can make Additional Voluntary Contributions outside those made by his/her employer.

The Retirement Savings Accounts are powerful accumulators of compounded investment returns because they have a tax-exempt advantage for cash contributions and investment returns. The fact that mandatory funds in Retirement Savings Accounts cannot be withdrawn at will, helps to create a compounding stream of income unimpeded by tax deductions.

You Need a Retirement Plan

The most important financial plan you can have and should have is a retirement plan. Your retirement plan is even more important than your child’s education plan.

Now, when you do decide to get a Retirement Savings Account, you the employee should be responsible for the following:

- Selecting a Pension Fund Administrator

- Making an 8% contribution to your Retirement account

- Ensuring your employer matches your contributions with a 10% contribution to your retirement account

- Making regular Additional Voluntary Contributions to your account.

Planning Your Retirement

The time to plan for retirement is when you are 20 and just starting to earn income. Remember, your retirement is a financial event that can happen when your passive income can cover your non-discretionary income.

[Read Also: Millennials’ silence towards pension is a great concern]

Therefore, how do you plan towards that? First, determine your Work Life Expectancy WLE. Your Work Life Expectancy is the period of time you expect to be in the workforce. Take for example: if you are 30 years old and you expect to retire at age 65, your WLE is 35. WLE is important as it signifies how long you have to accumulate and save in your RSA towards retirement.

The next thing to determine is your Retirement Life Expectancy RLE. The RLE is the time from retirement till death. Thus, we have three stages, the Pre WLE, the WLE, and the RLE. You only earn during the WLE period. This is the period you accumulate and invest your earnings. What you earn and save during your WLE should fund your consumption in your RLE period. If you don’t save during your WLE period, you expose your RLE period to peril.

Retirement should now equate as the period when your passive income can fund your RLE. The earlier you save during your WLE is very important and it has a huge impact on your final return.

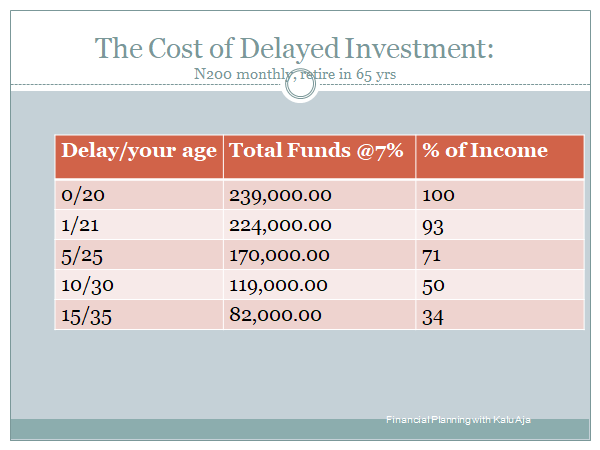

See a schedule that costs out delays in investing for your retirement. In this example, the WLE is 65. If the client invests N200 per month at 7% when he is aged 20 years, he will have N239,000 in 45 years.

If the same client invests N200 per month at 7% when he is aged 35 years, he will have N82,000 in 45 years. Thus a delay in starting to invest for retirement for 15 years, costs the client N157,000. Specifically, if you don’t have a Retirement Saving Account, open one today and start contributing.

[Read Also: Pension fund administrators pile up cash in anticipation of withdrawals]

A successful retirement plan is based on a successful investment plan, and a successful investment plan is based on early, steady, retirement savings over time, and the earning on those contributions.

So a retirement plan is based on first a calculation of how much you suppose you will need in your RLE period. When you get this figure, you then determine what to save during your WLE period so you walk backwards. Eg you are aged 30, you want to retire when you are 60 years old, this means your WLE is 30. You determine your RLE is 30 years. You also determine you need N1 million a year in retirement for your 30 years (RLE), thus your expected spend during retirement is N1 million x 30 years or N30 million.

The question, therefore, becomes about how much we should accumulate in 30 years so that we can buy an investment that pays you N1 million a year for 30 years. Assume interest rate of 7%. To solve this, we calculate what is called the Present Value of an Annuity and the answer is N 12.4 million. So during the client’s 30 years WLE, he has to accumulate N12.4m in saving by age 60. It is this N12.4 million that will be used to buy an annuity.

What is an Annuity?

An annuity is basically a fixed sum of money paid over the lifetime of a person, in consideration of a lump sum paid by the person. In effect, you give the Insurance or Pension company a bulk sum of money, they commit to paying you a fixed sum every month, quarter, or year for the rest of your life.

Remember that the RSA is a pay increase, as long as your employer matches you and contributes the mandatory 10%, you are receiving a 10% salary increase.

How to Maximize the Retirement Savings Account?

- First, ensure mandatory contributions are made every month. Contributions and Investments returns are tax-free. Regular contributions compound longer and thus provide a larger return.

- All contribution and investment income earned made to a Retirement Savings Account are tax-free. This means if you make Additional Voluntary Contributions to your Retirement Savings Account you effectively reduce your Income Tax burden.

- Use Additional Voluntary contributions as a “catch up” mechanism, if you are behind in your retirement saving, contribute more in bulk to your RSA via the AVC window.

[Read Also: Nigeria’s pension contributors add N186.43 billion to pension asset]

Nice one.

Next topic :

Additional Voluntary Contributions

Pls

Beautiful and educative write up. I cannot thank you enough. God bless you real good.

Can a self employed person open retirement savings account

This is theoretically okay, but very different from the operation in the Nigerian Pension Industry. I think the writer should research more on the laws governing the withdrawal modalities, options and their calculation in the current pension set up to present a more balanced perspective to this article.

This piece is priceless. Thanks a lot