Generally, price indices are measures of proportionate or percentage changes in a set of prices over time. According to the International Labour Organisation (ILO), the “Consumer Price Index (CPI) measures changes in the prices of goods and services that households consume”.

More explicitly, the International Monetary Fund (IMF) describes the “CPI as an index number that measures changes in prices of goods and services purchased or otherwise owned by households, which households use directly or indirectly to satisfy their own needs and wants”.

In practice, the CPI is built using household surveys carried out at intervals to capture the expenditure and consumption patterns of households. Hence, the CPI basket differs across regions and countries as the weights attached to the commodities in the basket reflect the share of the household budget represented by the commodity.

Due to the dynamic nature of consumption and expenditure in the economy, the weights attached to the commodities and services change over time as consumers’ taste and income evolve, allowing several goods and services to replace previously consumed items or take a different share of household budgets.

Therefore, it becomes imperative that estimates of the CPI (and by extension the inflation rate), reflect prevailing consumption patterns, as inflation plays a critical role in the consumption, investment, wage and monetary decisions in the economy.

Composition of Consumer Price Index In Nigeria

According to the National Bureau of Statistics (NBS), the CPI comprises 740 regularly priced goods and services, broadly grouped based on the Classification of Individual Consumption According to Purpose (COICOP) standards.

The COICOP classification groups goods and services into thematic divisions that reflect similar purposes and use as consumed by citizens in the country. At the moment, the CPI basket in Nigeria is weighted based on a 2009 revision of the 2003/2004 National Standard of Living Survey. The weighting, as presently constituted, is displayed in Table 1 below, with the highest weight being attached to the Food and Non-Alcoholic Beverage category.

Reworking the Raffia, Evaluating the Components of the CPI Basket

Since the 2003/2004 National Living Standards Survey was carried out, the Nigerian economy has witnessed significant structural changes in the demand and consumption patterns, as well as the array of goods and services offered by producers in the market.

This raises concerns about the aptness of the estimations of consumption preferences and share of commodities in the household budget generated from the survey.

Notably, the surge in the share of telecommunications, recreation and culture, and entertainment-related expenditures in the overall household expenditure point to a new pattern in the consumption and expenditure of Nigerians.

It is also worthwhile to restate that although food expenditure might still constitute a significant portion of

household expenditures, the weights attached to other components of the COICOP divisions are worthy of evaluation. In addition, the likelihood of substitution and quality biases building up over time is without doubt as certain items such as the telephone and telefax equipment and services are overdue for replacement with items that are more amenable with current consumption patterns.

Global Norm

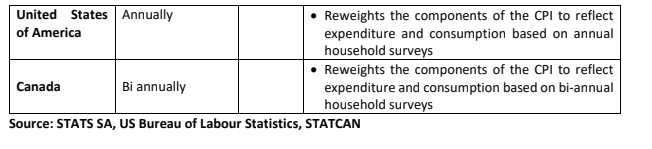

On the average, countries across the world review the components of the CPI basket and the weights attached to them every 3-5 years, as they expect that consumption patterns would have shifted over the period. In 2010, the South African Statistical Office stated that the CPI basket will be retooled every three years to reflect the socio economic conditions and the latest revision was effected in January 2017. Table 2 below details some of the revision witnessed in the US, Canada and South Africa from 2009 till date.

Call to Action

The premise supporting the re-evaluation of the components of the CPI basket as well as the weights attached to them is explicit and there is no doubt that the current CPI basket in Nigeria is not synchronized with present realities. More importantly, the policy, livelihood, and investment implications of the estimates of the consumer price index and by extension, the inflation rate, necessitate that the dynamics inherent in the consumption and expenditure patterns are properly captured and adequately reflected.