The Central Bank of Nigeria (CBN) has declared that Nigeria currency (Naira) exchange rate is now floated, which implies that the Naira exchange rate will now be fully determined by market forces of demand and supply.

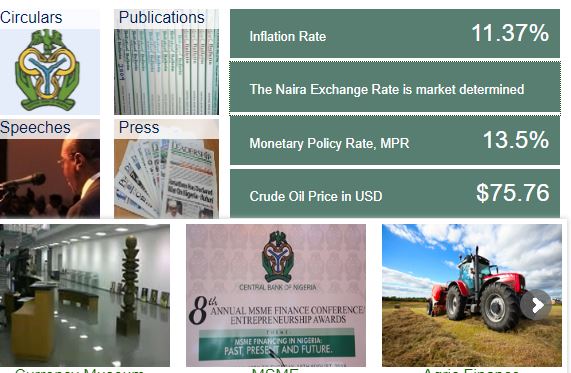

Exchange rate float: According to the information obtained on the CBN website, the exchange rate data on the CBN macroeconomic indicator’s section has been removed and replaced with “The Naira exchange rate is market-determined“. A market-determined exchange rate is often referred to as one that is floating or a floating exchange rate.

The website has reflected this change since May, leading some analysts to opine that the CBN may have surreptitiously decided to float the naira.

But a further click into the link shows the exchange rate remained between N305 and N307, which is the Central Bank’s official rates. This has also been the same rate it has sold dollars for over two years since the last depreciation. So why then is the CBN informing the market that “the Naira exchange rate is market-determined”?

Was it an error or is it sending a subtle signal to the market that it has finally agreed to adopt a market-driven exchange rate?

More details: There are multiple exchange rates in Nigeria. The Central Bank’s official rate is (was) N305/$1 which is also published on its website and has been that way for years before the latest change depicted above.

Meanwhile, the parallel market (bureau de change) is the most patronized for individuals, travellers and even businesses. In the parallel market, price is specifically determined by market forces of demand and supply.

Note that in 2017, CBN officially introduced a multiple exchange rates system, which added the establishment of the Investors’ & Exporters’ FX (I&E) window to the existing official bank rate. According to CBN, the move was a continued effort to deepen the foreign exchange (FX) market and accommodate all obligations.

“The purpose of establishing the I&E FX market is to boost liquidity in the FX market and ensure timely execution settlement for eligible transactions.”

In the I&E window, the supply of foreign currency to the window is done through portfolio investors, exporters, Authorised Dealers and other parties with foreign currency to exchange naira. Also, CBN is a participant to promote liquidity and ensure professional market conduct. The I&E window is market determined and is viewed as a major reason for the stable exchange rate currently seen in Nigeria.

The Bottom Line: While the CBN is yet to issue an official statement to the change in the Nigeria exchange rates system, what this suggests is that the CBN has finally accepted that the exchange rate will henceforth be determined by the forces of currency demand and supply. Perhaps, the CBN is bracing itself for a possible exchange rate convergence in the no distant future.

Nevertheless, CBN has continuously intervened by injecting billions of dollars to defend the naira due to excess demand for the dollar. Whether this means CBN will stop intervening in the FX market remains yet unknown.

Note: This article was updated on June 12 to reflect new information

Its the official rate which is 305 NAIRA that is on free float so that the Naira can converge and scrap the multiple exchange rates

When u say NAIRA is on free float you may confuse the reader and they may thing you are also referring to the FX windows rate .which is 360 plus naira . The cbn has vowed not to devalue the Fx rate few days ago Emeifele said with about 45Billion reserve he will continue to intervene at the I&E forex window if need be even Dangote said he will not support devaluation at the same meeting

As well as indicating the FX (IE) on this site, it helps to also know the rate for the more active window – the Bureau de change rates. Most Nigerians still patronise this window for education fees, even business financial transactions.