Plunge in Non-interest Income Weakens Gross Earnings: In the first quarter of 2019, Zenith Bank’s gross earnings dipped by 6.55% to N158.11 billion, dragged by lower non-interest revenue despite the 4.94% uptick in interest income. We note that the bank has carried a derivative loss on its book for four (4) consecutive quarters, placing downward pressure on its non-interest income.

We expect that trading income will continue to be a drag to non-interest income given the modification of its model for treasury asset holdings. We also expect the derivative position to continue to moderate, hence our projection of a marginal decline of 0.98% in non-interest income by FY2019. Interest expenses declined by 22.21%, as pay downs on borrowed funds moderated the bank’s debt obligations.

Consequently, the cost of funds improved to 3%. Through improved operational efficiency which tempered the cost to income ratio to 50.90% and a 54.17% decline in impairment charges, PAT grew by 6.70% to N50.23 billion. Based on our review of its financial performance in Q1:2019, there was no material deviation from our initial growth projection. Consequently, we maintain our expectation of a 4.19% growth in gross earnings and a 9.98% growth in PAT to N212.72 billion

Cost Efficiency Continues to Deliver Value: Customer deposits dipped by 3.22% following a 7.21% decline in demand deposit which worsened the CASA mix by 233bps to 63.44%. However, the bank recorded a lower cost of funds (3.0% vs 4.0% in Q1: 2018) owing largely to lower interest on borrowings in the quarter.

Through improved operational efficiency, the bank has been able to cut down on its costs and strengthen its CIR to 50.90%. This improved CIR has helped cushion the decline in non-interest revenue and thus, slower growth in operating income. With our expectation of a lower yield environment and the decline in non-interest income, we expect cost efficiency to drive profit in subsequent quarters.

Modified Business Model for Treasury bills holdings: Zenith Bank, which holds 13.78% of its total assets in treasury bills, made modifications to its treasury bills business model in response to the expectation of a lower yield environment in 2019. We observed that the proportion of treasury bills held at amortized cost increased by 53.04% while the proportion of instruments held at fair value through Profit and Loss (FVTPL) reduced by 978.48%.

Thus, the new model translates to reduced trading activities on the instruments, hence reduction in trading gains on them. This objective is further strengthened by holding longer maturity instruments to alleviate reinvestment risk. These will enable the bank to maximize interest income on Treasury bills with a resultant decline in trading gains and non-Interest income.

Prudential ratios remain stable: From a regulatory standpoint, Zenith Bank’s prudential ratios all remain within regulatory bounds as Capital Adequacy Ratio (25.00%), Loan to Deposit Ratio (43.00%), Liquidity Ratio (66.70%) and Non-Performing Loan Ratio (4.85%) remain in line with CBN guidelines. We expect the bank to keep these ratios in order through the year as we do not foresee any significant occurrences derailing these ratios.

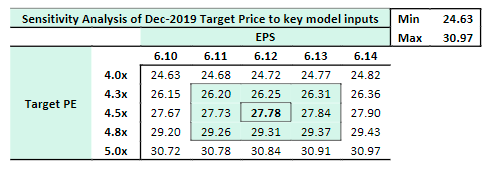

Recommendation: Following our review of the bank’s performance and its position as at Q1:2019, we maintain our EPS forecast of NGN6.12 and expected PE of 4.54x, resulting in the December 2019 target price of N27.78.

Brokerage and Retail Services

topeoludimu@meristemng.com (+234 905 569 0627)

abisoyeoludipe@meristemng.com (+234 708 000 7861)

contact@meristemng.com

Investment Banking/Corporate Finance

senamijohnson@meristemng.com (+234 806 011 0856)

seunlijofi@meristemng.com (+234 808 536 5766)