Welcome to Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills. This is brought to you by Zedcrest.

This report is dated May 20th, 2019.

***Nigeria’s economic growth slows in Q1 2019, as oil sector contracts*** – NBS

Key Indicator

Bonds: The FGN Bond market remained scantily traded, but with yields sliding lower by c.9bps on the day, as market players reacted to the continued downtrend in short term T-bill rates.

The CBN MPC committee will decide on the level of the benchmark interest rate (MPR) alongside other related parameters at its meeting tomorrow, and ahead of the FGN Bond Auction scheduled for Wednesday. Regardless of the decision at the MPC, we expect the market to remain bullish, barring a resumption in OMO issuance by the CBN.

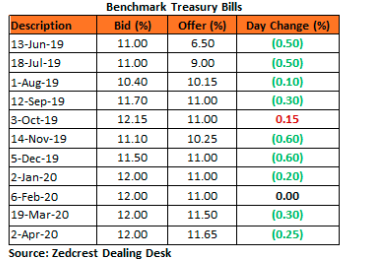

Treasury Bills: Rates in the T-bills market crashed to new lows in today’s session, as the lack of an OMO auction in the previous week was further exacerbated by the sizeable amount of system liquidity which spurred further buying interests mostly around the mid tenured bills.

Rates are now being traded below 12.00% across the curve, with the heaviest declines currently being witnessed around the mid tenors. The Sovereign yield curve has consequently normalized fully and might be a precursor for a further cut in the MPR at this MPC meeting or the next.

We are however on the lookout for further guidance from the CBN as it continues its struggle with high inflation and the stability of the exchange rate, whilst also looking to fuel some growth within the domestic economy, which recently witnessed a slowdown from the previous quarter.bi

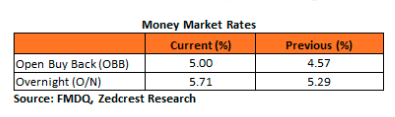

Money Market: Rates in the money market inched marginally higher by c.0.5pct as banks funded for the CBN’s weekly wholesale FX sale. The OBB and OVN rates consequently ended the session at 5.00% and 5.71%, with system liquidity currently estimated at c.N180bn positive.

We expect rates to remain relatively stable, barring a renewed OMO sale by the CBN.

FX Market: At the Interbank, the Naira/USD rate decreased marginally by 0.02% to N306.90/$ at the spot market, while the SMIS rate remained unchanged at N356.60/$. The NAFEX closing rate in the I&E window however rose slightly by 0.06% to N360.72/$. At the parallel market, the cash and transfer rates remained unchanged at N359.00/$ and N363.50/$ respectively.

Eurobonds: The NIGERIA Sovereigns traded relatively flat, with only slight gains witnessed on the shorter end of the curve.

The NIGERIA Corps were also relatively muted, except for slight sell interest witnessed on the ZENITH and FIDBAN 22s.

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.