The impact of Government’s debts size on a country’s economic growth has been widely debated, thereby generating rows among economists and policymakers. Note that the Government incurs a budget deficit when its total outlays exceed the total revenues.

While the Government can finance its expenditure through taxes and borrowing, borrowing is also another way to do that. However, borrowing produces follow-up costs in the form of interests and possibly principal payments in future fiscal years. Hence, persistent borrowing to finance budget can hamper economic growth.

Since the 1980’s debt crisis, debts accumulation have been a major economic problem facing many developing countries such as Nigeria. Essentially, several developing countries were not in a good position to hold out the second oil shock which happened in the late 1970s. Consequently, developing countries were plunged into hard times as the world’s recession in the early 80s following the oil shock, led to stringent debt conditionalities from lender countries.

In Nigeria, total debts have been on the rise. While the Nigerian Government maintains that the country’s 24trn debts are sustainable, the International Monetary Fund (IMF) has decried at several times that Nigeria’s debts profile is worrisome. Meanwhile, the debts profile of states in Nigeria is indeed worrisome.

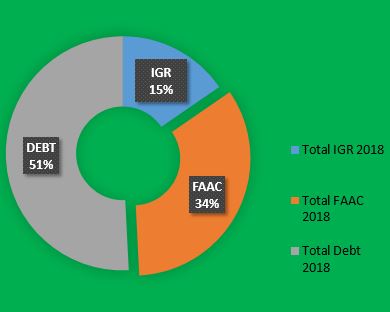

States debts are rising faster than abysmally low IGR – The National Bureau of Statistics recently released data for Internally Generated Revenue (IGR) for the last quarter of 2018, which shows that total states’ IGR amounted to N1.16trn in full-year 2018. Similarly, the total statutory allocation received from the Federal Government by all states of the federation in 2018 was 2.56trn. The cumulative figure of IGR and Statutory allocations indicates that all states generated a total of N3.73tn in 2018.

On the contrary, the total debts for all the states stood at 3.85trn in 2018. This implies that total debts across states are 3 percent higher than the total revenue generated across states.

Worrying statistics as Debts crowded-out 4-year IGR – Analysis of the states’ IGR for the past four years under President Buhari’s administration shows that the cumulative IGR for all the states across the federation is estimated at N3.54trn.

Similarly, the cumulative IGR for the last four years under the former president, Goodluck Jonathan shows an estimated IGR of N2.4trn. This indicates that four years each under the two administrations, the total external debt (3.85trn) to all states crowded out all its total revenue.

However, the huge borrowing across states in Nigeria has become necessary, following the fall in revenue as a result of the fall in the price of crude in 2014, and the attendant devaluation of the Naira from the use of the external reserve to defend the National currency.

What the debt policy stipulates – According to Nigeria’s debt management strategy (2016-2019), borrowings (both domestic and external) are expected to be used to fund priority infrastructure projects, which will boost output and put the economy on the path of sustainable growth and competitiveness. However, some states have actually borrowed to fund recurrent expenditure.

[Also Read: States’ IGR hits N1.16trn in 2018, as Lagos maintains first spot]

Also, it is stipulated that a state should not borrow more than 50% of the revenue generated. The Fiscal Responsibility Commission (FRC) stated in 2017:

“In the light of the DMO’s Guidelines on Debt Management Framework, by law, STATES not allowed to borrow more than 40 percent of their internally generated revenue (IGR) to allow for the remaining 60 to be used to run their states.”

23 States exceeded borrowing limits – It was disclosed by the FRC in 2017, that contrary to the guidelines of the DMO on sub-national borrowing, 23 states of the federation exceeded their borrowing limits in 2015.

FRC reported that Lagos, Kaduna, Cross River, Gombe, Ekiti, Edo, Ondo and Imo states had borrowed more than 50 percent of their annual statutory allocations by 2015. Other states in the same boat are Zamfara, Adamawa, Oyo, Abia, Ogun, Taraba, Kebbi, Enugu, Bauchi, Nasarawa, Kano, Benue, Kwara, Katsina and Sokoto.

It was further stressed that when total revenue (gross statutory allocation plus Internally Generated Revenue) was used as the yardstick for measuring the level of indebtedness of the states, a total of 20 states borrowed more than their total revenues in 2015.

Despite exceeding the borrowing threshold, several states still owe salaries without major developmental projects.

[Also Read: Minimum wage implementation: NLC and State Governors set for another struggle]

The future is bleak for many states, and Nigerians need to worry – DMO stated in its strategy document;

“The significant drop in revenue poses a substantial risk to the public debt portfolio if measures are not taken to structure the portfolio in line with current economic realities.”

Earlier, it has been reported that the organised labour union (NLC) and State Governments are set for another struggle over minimum wage implementation.

The economic realities suggest the new minimum wage may never be implemented across many states, and that the masses may have to prepare for that major setback. Again, State Governors will be faced with dilemma of either face-lifting infrastructures or implementing a minimum wage. With the FG also facing its own debt profile, bailout may not be provided to any state this time around.

Until states begin to diversify their revenue base from statutory allocations, the struggle to reduce debts burden will continue and economic development may not be achieved anytime soon in the country.