Welcome to daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

The report is dated April 29th, 2019.

Key Indicators

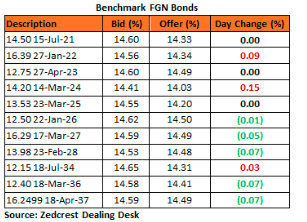

Bonds: Risk-off sentiments on FGN Bonds continued today as the market opened the week on a quiet note. Market trading volumes remained on a decline with less than N1bn executed intraday, reflecting the weak appetite for FGN bonds. Consequently, yields traded flat across the curve, with slight sell-off seen at the long-end of the curve (2036s).

In the coming week, we expect the market to remain largely order-driven, with client demand expected to come in to take advantage of the relatively higher yields on the mid to long end of the curve above the 14.50% mark.

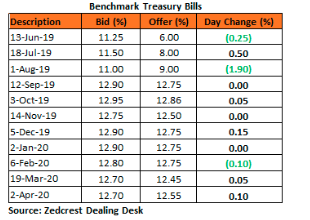

Treasury Bills: The T-bills market opened the week on a bullish note, as yields compressed by c.13bps on the average across the T-bills curve. The bullish trend was however at the short-end of the curve, particularly around the 91-day maturity. Yields however expanded across the mid- to long-end of the curve, as market participants position ahead of the coming PMA auction later in the week.

We expect client demand for T-bills to be sustained this week, as investors will also look to re-invest funds from CP and OMO maturities of c.N40bn and N62.80bn respectively.

Money Market: OBB and OVN rates opened the week at 16.43% and 17.29% as outflows from the previous week’s auctions fuel funding pressures. System liquidity is estimated to close the session at c.N50bn positive.

We expect rates to remain in double digits for the earlier section of the week. However, FAAC disbursements of c.N350bn and OMO Maturity of N62.80bn is expected to moderate rates later in the week.

FX Market: At the Interbank Market, the Naira/USD rate lost 5k to close at N306.95/$ (Spot) while the NAFEX closing rate in the I&E window also depreciated by c.0.4% to end the session at N360.79/$. Market turnover declined by 68.24% DoD to close at $165.75m. At the parallel market, the cash rate and transfer rates also depreciated by c.11% to close at N358.80/$ and N363.00/$ respectively.

Eurobonds: The NGERIA Sovereigns continued its bearish run from the previous week, as yields expanded by c.2bps across the curve. We noticed softer prices particularly on the mid- to long-tenor papers, despite some stability in global oil prices.

The NGERIA Corps opened the week on a mixed note. During trading, we noted selling interest particularly on FBNNL 2021 and demand remained for the ECOTRA 21s, FIDBAN 22s, and ETINL 24s, as Nigerian banks released Q1 performance figures.

Contact us: Dealing Desk: 01-6311667, Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.