Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

This report is dated April 23rd, 2019.

CBN resumes OMO Auction after a 3-weeks Hiatus, sells N166.58Bn

***Brent crude maintains gains as the US toughens policy in Iran***

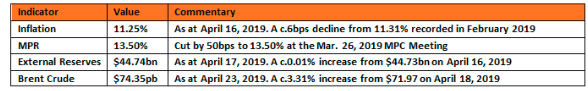

Key Indicators

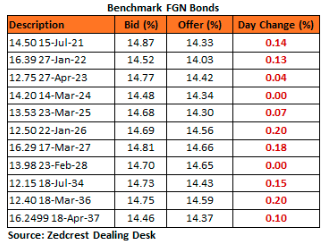

Bonds

The FGN Bond market traded on a quiet note, yesterday, with sparse volumes executed during the trading session. Yields across the benchmark curve compressed marginally by c.3bps, with some demand witnessed on the 2036 maturity.

At the Primary Auction tomorrow, the DMO will offer a total of N100bn, with the re-opening of the 5-year, and new issues for the 10- and 30-year tenors. The much-anticipated 30-year issuance will be the highlight at the auction, as investors look to price the debut longest- duration Naira bond maturity.

Treasury Bills

The T-bills market traded on a mixed note today, with initial demand seen at the mid- to long-end of the NTBill curve. However, upon the announcement of an OMO auction by the CBN mid trading, we saw a reversal in yields as traders sold off long-end maturities in anticipation of the renewed supply of OMO T-Bills.

At the OMO auction, the CBN sold a total of N166.58bn across three maturities. The stop rates for the 93-, 184- and 359-day tenors were 11.80%, 12.90%, and 13.029% respectively, marginally lower than the previous auction.

We expect yields to trend higher for the rest of the week as the system liquidity remains pressured by outflows from FX and Bond Auction funding later this week.

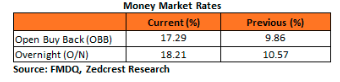

Money Market

Interbank funding rates increased off the back of liquidity mop up by the CBN via an OMO auction and Wholesale FX funding. The OBB and OVN rates consequently ended the session at 17.29% and 18.21% respectively, with system liquidity estimated to have closed at c.N140bn positive.

We expect rates to remain pressured for the rest of the week, as the CBN takes out more liquidity via its bi-weekly Retail FX sales and Monthly FGN Bond auction.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.90/$ (Spot) and N356.26/$ (SMIS) opening the week. The NAFEX closing rate in the I&E window depreciated slightly by 0.04% to N360.52/$, whilst market turnover dipped further by 47% to $141m. At the parallel market, the cash rate remained unchanged at N358.50/$, whilst the transfer rate appreciated by 0.27% to close at N363.00/$.

Eurobonds

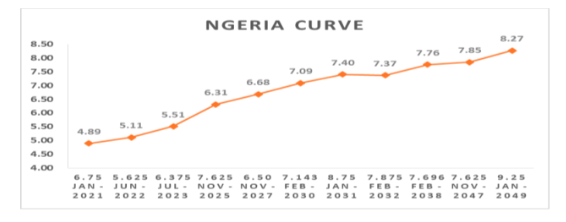

The NGERIA Sovereigns witnessed slight demand on some select papers across the curve, most notably the NGERIA 49s. The yield curve remained stable for the second trading session, despite gains recorded in global oil prices over the break.

Activity in the NGERIA Corps opened the week with slight demand across most tracked tickers. We expect sustained demand going into the week as investors look to re-invest proceeds from the 6.25% ZENITH 2019 Eurobond that was redeemed on Monday 22nd April 2019.

_______________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com