The latest statistics released by the Nigerian Communications Commission (NCC) shows that broadband subscription/penetration increased to 63.1 million in February 2019.

According to the latest NCC data, broadband penetration in Nigeria increased to 33.08% in February, up from 32.34% in the previous month. In January, total broadband penetration was 61.7 million, while it rose to 63.1 million in February 2019.

What is Broadband penetration?

According to IGI Global, broadband penetration is used for measuring the extent of access to broadband communications within the population of a particular location.

It is usually computed as a ratio between the number of subscribers and the total population for a particular location.

The OECD revealed that broadband penetration is measured by the number of broadband subscribers per 100 inhabitants.

Global Broadband Penetration

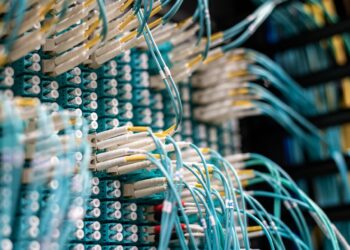

The share of high-speed fibre in broadband Internet connections in OECD countries has risen to 25%, up from 12% eight years ago, according to the OECD’s broadband portal.

Specifically, recent data shows that the highest growth in fibre over the past year has been seen in Ireland, Belgium, and Australia. In these countries, fibre subscriptions rose up 218%, 71%, and 70% respectively.

Mobile broadband continued its rapid expansion with an additional 98 million subscriptions, a rise of 7.4%, in the year to June 2018.

Nigeria’s growing Broadband Penetration

Nigeria has reportedly surpassed its earlier five-year target of 30 percent which was set for 2013 and 2018, through measures and strategies put in place by the NCC.

Following this, the Executive Vice Chairman of the Nigerian Communications Commission (NCC), Prof Umar Garba Danbatta, reportedly stated early in the month that the commission is ready to drive the process of attaining 70 percent broadband penetration in a couple of years.

“When I was appointed by President Muhammadu Buhari in 2015, broadband penetration was only 8.5 per cent. It has now risen to 33 per cent, an equivalent of 63 million Nigerians enjoying the services. I am particularly thrilled to see that the rising trend has not only been sustained, but the NCC is now ready to take it to the next level.”– Danbatta

Yet Nigeria is ranked among countries with the slowest internet in the World

Internet speed in Nigeria has remained slow and sometimes frustrating, despite the country’s record of rising subscription and wireless technology.

According to the latest ranking by the Ookla’s Speedtest Global Index, Nigeria is ranked 107th in mobile Internet download speed out of 137 countries in the world. In February, it was reported that the average mobile Internet download speed was 12.22 megabits per second down from 12.76 Mbps in January.

The ranking further indicated that Nigeria has not exceeded the 102nd Internet speed ranking in the past year despite rising 3G/4G subscriptions and reportedly cheap internet data subscription.

Similarly, the 2018 global ranking report for worldwide broadband speed released by Cable, Nigeria is currently ranked 152nd among 200 countries.

How bad can it be?

Slow or bad internet connectivity would have multiplier effects on every aspect of business and the economy. It would not only reduce investment opportunities but also result in I.T infrastructural decay in the country.

For instance, when transactions are delayed because of poor connectivity, time and money are lost and financial inclusion whose success largely depends on fast internet services is truncated.

Interestingly, Nigeria’s 2018 GDP shows that in terms of contribution to GDP, Information and communication contributes 12.22% to GDP. Hence, bad internet connectivity is setting growth on a precarious path.

In the 21st century, slow internet access puts individuals and businesses at great disadvantages positions. According to a report by Financial Times, poor internet connections are costing the UK economy up to £11bn a year, with 42 percent of small to medium-sized businesses reporting problems with connectivity.

Despite the tremendous potential and impact of the Internet, Nigerians and their businesses are still made bear the cost and curse at the moment.