Money Market

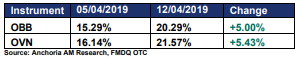

The money market rate increased last week as the Overnight rate (OVN) and Open Buy Back (OBB) rose to 21.57% and 20.29% from 16.14% and 15.29% respectively. Consequently, the average money market rate rose by 5.22% to settle at 20.93%

despite an increase in the system liquidity to cN267bn from cN105bn in the previous week as CBN suspended its liquidity mopping activities during the week.

Major inflow for the week included: OMO maturity of cN33bn and CBN retail FX auction

refund of cN165bn while Outflow for the week included: Weekly Wholesale, Invisible and SME FX auction of $210mn. The rise in the rates can be attributed to the inability of banks to access the CBN Standing Lending Facility (SLF) for their funding needs

during the week.

We expect the rates to inch higher on Monday as Banks prepare for another round of CBN weekly FX auctions on Monday.

Forex: USD/NGN

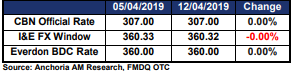

The CBN Official rate remained unchanged last week to close at N307.00/$ while the rate in the Investors and Exporters’ FX Window fell marginally by N0.01 to close at N360.32/$ due to increase in market turnover rate by 8.25% week-on-week to $1.18bn from $1.09bn in the previous week. However, Naira at the parallel market remained unchanged to close at N360.00/$ (using the Everdon BDC Rate).

We expect rates in the parallel market to remain constant as the apex bank continues to supply FX into the market, coupled with its frequent Wholesale and Retail SMIS programme.

Commodities

Brent Crude Oil and WTI Crude Oil rose by 1.72% and 0.73% to close at $71.55 per barrel and $63.54 per barrel respectively, as supply reductions outweighed fears of slowing economic growth due to reduction in OPEC supply, and geopolitical issues in countries like Venezuela, Libya and Iran.

Fixed Income Bond: FGN

The Bond Market closed on a bullish note last week despite sell offs and mild activities recorded on the first 2 trading days of the week. Average yields fell by 5bps to close the week at 14.25% following a buying interest witnessed on some bonds most especially the 2024s (-41bps) and 2022 (-32bps).

We expect market to continue to trade cautiously ahead of the April Bond Auction.

Treasury Bills

Due to the increase in system liquidity as CBN suspended its mopping up activities last week, the secondary treasury bills market closed on a bullish note. Consequently, the average yield fell by 9bps to close the week at 13.35%. The CBN is expected to hold its Treasury Bill Primary Market Auction on Wednesday 17th April 2019. The CBN is expected to roll over the same amount of bills maturing.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com