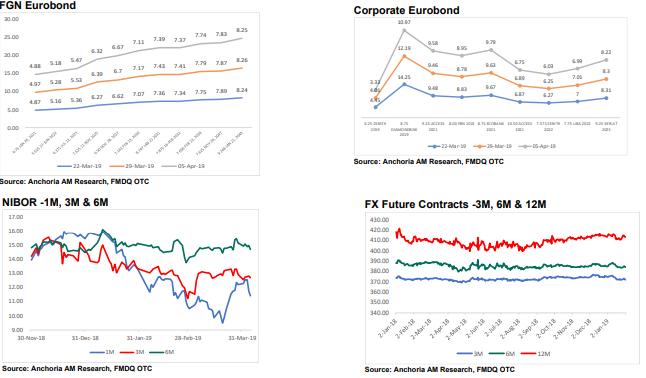

Money Market

The money market rate increased last week as the Overnight rate (OVN) and Open Buy Back (OBB) rose to 16.14% and 15.29% from 10.67% and 9.86%, respectively.

Consequently, the average money market rate rose by 5.45% to settle at 15.72% due to

decrease in the System liquidity to cN105bn from cN440.7bn in the previous week as CBN resumed its liquidity mopping activities during the week.

Major inflow for the week included: OMO maturity of cN80bn, while Outflow for the week included: Weekly. Wholesale, Invisible and SME FX auction of $210mn, OMO sales of cN526bn.

We expect the rates to inch higher on Monday as Banks prepare for another round of CBN weekly FX auctions on Monday.

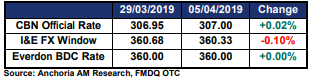

Forex: USD/NGN

The CBN Official rate continued its upward trend last week to close at N307.00/$, a 0.02% increase while the rate in the Investors and Exporters’ FX Window fell by 0.10% to close at

N360.33/$ despite a reduction in market turnover rate by 9.91% week-on-week to $1.09bn from $1.21bn in the previous week. However, Naira at the parallel market remained unchanged to close at N360.00/$ (using the Everdon BDC Rate).

We expect rates in the parallel market to remain constant as the apex bank continues to supply FX into the market, coupled with its frequent Wholesale and Retail SMIS programme

Commodities

Brent Crude Oil and WTI Crude Oil rose by 3.64% and 4.89% to close at $70.34 per barrel and $63.08 per barrel respectively, due to the reduction in OPEC production as the production volume hits a four-year low due to US sanction on Venezuela

and Iran.

The news over the sanctions against Iran intensified last week

when the U.S. said it was reducing the number of waivers previously granted.

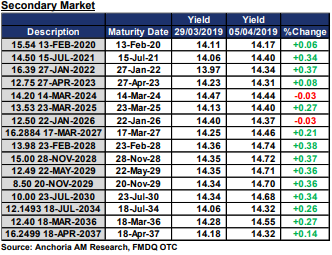

Fixed Income

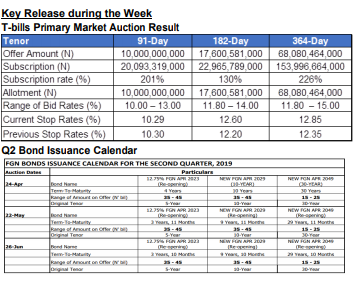

Bond (FGN): The Bond Market traded on a bearish note last week as the Debt Management Office (DMO) released the Q2 Bond Issuance Calendar. The Calendar released was in line with market expectation of issuance of fresh long tenored bond (30-year Bond).

We observed a significant sell off in longer tenored bonds most especially 2028s and 2029s Bond. Average yields rose by 23bps to close the week at 14.30%.

Treasury Bills

Despite the decrease in system liquidity as CBN resumed its mopping up activities last week, the secondary treasury bills market closed on a bullish note. Consequently, the average yield fell by 11bps to close the week at 13.44%.

The T-bills Auction conducted last week witnessed a high subscription rate across all tenor, surprisingly the spot rate rose by 40bps to 12.60% for 182 days and 50bps to 12.85% for 364 days while of 91 days the rate fell marginally by 1bps to 10.29%.

________________________________________________________________________

CONTACTS: Anchoria Asset Management Limited 5th Floor, Elephant House 214, Broad Street, Marina Lagos

Investment Research research@anchoriaam.com +234 908 720 6076

Wealth Advisory investor-relations@anchoriaam.com +234 818 889 9455