Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bond Yields Trend Higher Following Sell off on the 10-Year

***FEC Okays N3.4tn Promissory Note to Offset Local Debts, Salaries***

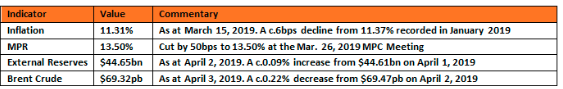

Key Indicators

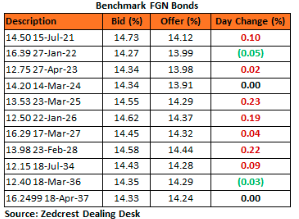

Bonds

The FGN Bond market traded on weaker note in today’s session, with yields ticking higher by c.7bps on average, following slight selloff on the 2028s and 2037s with yields traded as high as 14.50% and 14.33% respectively.

The bearish sentiment in the market came mostly on the back of some information on the possibility for a longer tenured bond in the Q2 calendar to be released shortly by the DMO.

We, however, anticipate a slightly lower amount of bond issuance in Q2 19, with an estimated monthly amount of c.N80bn from now to year end, compared to the average monthly amount of c.N125bn in Q1 19.

Yields are expected to remain slightly pressured, as selling interests persist in the market.

Treasury Bills

The T-bills market traded on a relatively flat note, with market players constrained by the tight system liquidity levels, whilst shifting focus to the CBN’s NTB auction where stop rates cleared higher owing to the signifcant OMO sale in the previous session.

We expect yields to remain elevated, with the possibility for a further OMO intervention by the CBN due to the c.N108bn in OMO maturities expected tomorrow. A further drain in system liquidty could however spark some bearish pressures as banks project for the bi-weekly Retail FX funding on Friday.

Money Market

Rates in the money market remained relatively unchanged from previous levels, as system liquidity remained subdued at c.N36bn opening the day. The OBB and OVN rates consequently ended the session at 16.71% and 17.50% respectively.

We expect rates to moderate slightly tomorrow, on the back of the expected OMO inflows. This is however barring a significant further OMO sale by the CBN.

FX Market

At the Interbank, the Naira/USD rate was unchanged at N307.00/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window however weakened slightly by 0.07% to N360.55/$, as market turnover dropped by 59% to $165m. At the parallel market, the cash rate depreciated by 0.06% to N358.20/$ whilst the transfer rate remained unchanged at N364.00/$.

Eurobonds

Interests on the NGERIA Sovereigns remained relatively muted in today’s session, with yields ticking marginally higher by c.1bp on the day.

In the NGERIA Corps, Investors remained well bid on the DIAMBK 19s, UBANL 22s and FIDBAN 22s.

Contact us:

Dealing Desk: 01-6311667

Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

the platform is highly lucrative an life touching technics