Chams Plc released its results for the 2018 financial year, last week. There was a significant increase in the top line as well as a return to profitability.

Revenue increased from N1.9 billion in 2017 to N3 billion in 2018. The company also made a profit after tax of N380 million, as against a N1.2 billion loss recorded in the corresponding period of 2017.

A section from the company’s financial statements disclosed that the firm has decided to pay a dividend of N0.03 per share:

The Board of Directors, pursuant to the powers vested in it by the provisions of section 379 of the Companies and Allied Matters Act (CAMA) of Nigeria, proposed a final dividend of 3k per share as at December 31, 2018. This will be presented for ratification by the Shareholders at the next Annual General Meeting

This amounts to a payout ratio of 42.8%, as the company had earnings per share of N0.07.

The proposed dividend is the first in over five years.

Red flag

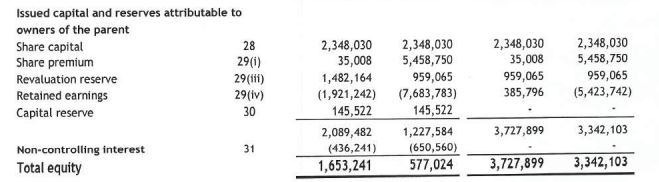

While the company’s return to profitability is a positive development, the decision to pay dividends is a somewhat odd one. Chams currently has negative retained earnings of N1.9 billion.

By law, companies are not allowed to pay dividends from negative retained earnings.

About the Charms Plc

Chams Plc (the company) was incorporated as a limited liability company on 10 September 1985 and became a public company on 4 September 2008.

The company was listed on the floor of the Nigerian Stock Exchange on 8 September 2008.

The principal activities of Chams Plc and its subsidiaries (the group) include identity management, payment collections, and transactional systems.

The stock closed at N0.20 in today’s trading session on the Nigerian Stock Exchange, down 4.76%. Year to date, the stock is flat.

At last! Chams Plc appears to show some signs of life. Please could you provide any detail on the relevant section of the law that prohibits a company from paying dividens if the company has negative retained earnings? Thank you.

Cham Plc is a group of company. Dividend is paid from the retained earnings of the company which as at this date was approximately N386 million. If this can accommodate the declared dividend, Chams is well in line to declare and pay dividend.

Good morning. I concur with your points, but the results do not specify if the dividends are being paid from the company or group. Rule of thumb states profits are usually paid from the group.

Very good performance and turn around for the Company.

I advise the writer to look again at the displayed account. It is obvious that the Retained Earning is positive for the Company but negative for the group.

Since, it is the Company that pays dividend and not the group, there are free to pay Dividend.

The whole world need to commend the Company for being compassionate with the Dividend pay out.

I am a shareholder and I am happy

Thank you for your analysis of Chams group financials and your interest in the company’s performance.

Chams group consists of: Chams Plc, ChamsAccess Ltd., ChamsSwitch Ltd., Cardcentre Ltd., ChamsConsortium Ltd., and ChamsMobile Ltd.

Though, Chams group has a negative retained earnings of N1.9bn while the company, Chams Plc has positive retained earnings of N385 million as reported in the financial statement.

It would interest you to know that Chams Plc (the Company) proposed dividend of 3k per share out of 7k EPS from positive retained earnings of N385 million.

In addition, Chams Plc is the listed company on the Nigeria Stock Exchange and not the Chams Group. Therefore, the proposed dividends is from positive retained earnings of Chams Plc.

Good Morning. I agree totally with your analysis, but the result does not specify. The group and the company both made profit.

Onome, I believe you saw my first comment on the piece. I await your response. Kindly educate a reader.

Thanks for the enlightening comment.