Transactions failure on e-payment platforms in Nigeria are increasingly becoming a concern to millions of users.

Note that some of the e-payment channels in the country are Automated Teller Machines (ATM), Point of Sale Terminals (PoS), and Electronic Money Transfers, among others.

Nairametrics had earlier reported that e-payment transactions’ failure (which includes POS debit errors, cards’ rejection, and POS network glitches), poses setback and frustrate users.

In recent times, there has been a deluge of “dispense errors” and non-reversal of failed transactions at the Point Of Sale (POS) terminal and ATM.

On a typically bad day, as much as 30,000 transactions can become botched, even as bank customers’ accounts are debited, thereby leaving the financial institutions and their clients at loggerhead.

The Nigeria Inter-Bank Settlement System (NIBSS) should solve this

Among other functions, the core of NIBSS is to basically provide infrastructure for the automated processing and settlement of transactions between banks acting on their own account as regards deposit placements, Treasury Bills Transaction, and Naira settlement on inter-bank foreign exchange transactions.

Failed transactions on the rise

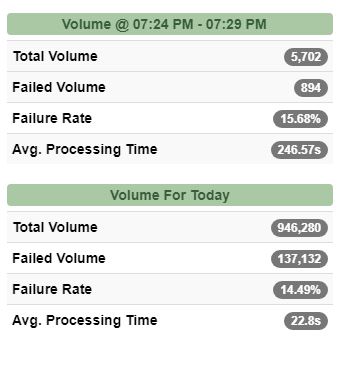

Data from the NIBSS website shows that as at the time of filing this report, the failure rate of the transactions on POS stood at 15.68%. For just a day, NIBSS recorded 137,132 failure rate. That is such a high rate of failure.

Speaking on this development, a bank official said the following:

“NIBSS has severally apologized to us and promised to step their system upgrade. I think the problem is more of system overload because the e-payment system has been widely accepted and used, which infrastructure may not have been projected adequately.

However, NIBSS spokesperson, Lilian Phido, said;

“it is an industry system glitch, which involves several stakeholders- banks, payment service providers and even the Central Bank of Nigeria.

“I cannot be here now to pass the buck or apportion blames. When issues like these come up, the tendency to apportion blames and not be responsible is there. The truth is that there are issues, but they are industry glitch. Everyone is needed to resolve it.”

Industry glitch? But POS transactions dropped by 13% in just two months

Data has shown that there was a decline in the volume and value of POS transaction so far in 2019. Nigerians spent the sum of N416 billion on Point of Sale (POS) transactions in between January and February 2019. This is according to data obtained from the NIBSS webpage.

According to the NIBSS data, N222.921 billion was spent in January 2019, while N193 billion was spent in the month of February. This represents a N29bn fall in value of POS transactions for February 2019, indicating a 13% decline when compared to the POS transaction for the previous month of January.

Also, the Volume of POS transactions declines

The volume of POS transactions for the past two months in 2019 shows that 53,941 transactions have been made. In January 2019, the volume of POS transactions stood at 28,162. This indicates a decline in the volume of POS transactions by 8% between January and February 2019.

When compared to 31,926 volume of POS transactions recorded for December 2018, it shows a decline in the volume of POS transaction in early 2019.

Meanwhile, the number of registered POS terminals inch up by 2%

NIBSS data has shown that the number of registered POS terminals increased by 2% between January and February 2019. In January, the number of POS terminals stood at 266,418, while it increased to 272,272 in February 2019.

The new figure for registered POS terminals shows that the number of POS terminals have been on the rise in Nigeria for the past years. For instance, in January 2017, the number of POS terminals stood at 134,906. And then it rose to 272,272 in February 2019, indicating a 100% increase in just two years.

Also, NIBSS deployed more POS terminals despite glitches

Despite the drop in the value and volume of POS transactions for the first two months of 2019, data shows the number of POS terminals deployed across the economy increased to 22,924 in February 2019 from 223,098 in January. This indicates a 1 percent rise in the number of POS deployed fro the review period.

An overhaul?

As rightly noted, failed e-payment transactions is a perennial problem in the Nigerian financial sector. Whatever is the technical or structural deficiencies, Nigerians deserve efficient e-payment channels. As Nigeria has carried out several reforms to reposition its banking sector, an important component of the reforms cannot be left to suffer.

Also, the economy is being threatened by this persisting issue. And the CBN Need to do more to address it.