Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Funding Rates Close Stable as FAAC Inflows Bolster System Liquidity

***FG plans to borrow N1.6tn in 2019*** — DMO

Key Indicators

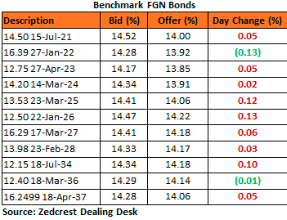

Bonds

The FGN Bond market traded slightly bearish as selling interests persisted on the mid to long end of the curve. We however witnessed slight demand on the short end of the curve (2022s), with yields ending the session c.4bps higher on the day.

We expect the market to remain relatively quiet going into the new week, with market players speculating on the possibility for increased supply of bonds in the new quarter.

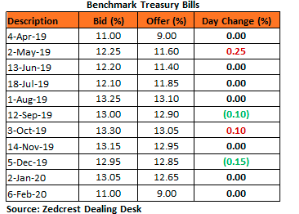

Treasury Bills

The T-bills market remained relatively flat despite the continued absence of an OMO auction by the CBN. Trades were mostly order driven and on the mid to long end of the curve, with yields marginally lower by c.3bps on the day.

Market players have maintained a cautions stance in anticipation of a renewed OMO auction by the CBN, given the inflows from FAAC payments which have bolstered system liquidty levels. We consequently expect the market to be relatively stable in the near term, baring a continued hold off on OMO which could taper rates slightly lower.

Money Market

Rates in the money market remained relatively stable as the CBN held off on OMO, while inflows from FAAC payments (c.N300bn) helped moderate funding pressures from the retail FX provisioning by banks. The OBB and OVN rates consequently ended the session at 9.86% and 10.67%, with system liquidity estimated at c.N200bn closing the week.

We expect rates to remain relatively stable opening the new week, barring a significant OMO sale by the CBN.

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window appreciated by 0.03% to N360.68/$, as market turnover rose higher by 77% to $359m. At the parallel market, the cash rate appreciated markedly by 0.22% to N357.50/$ whilst the transfer rate remained unchanged at N364.00/$.

Eurobonds

The NGERIA Sovereigns turned bullish in today’s session, with renewed interests witnessed mostly on the long end of the curve. Yields were consequently lower by c.13bps on the day

In the NGERIA Corps, Investors remained bullish on the ZENITH and FIDBAN 22s, while they turned slightly bearish on the ACCESS 21s sub and FBNNL 21s.

__________________________________________

Contact us:

Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com