Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bond Auction Rates Crash by 125bps Following N92bn Non-Competitive Sales

***FG, States, LGs share N619.857bn for February***

KEY INDICATORS

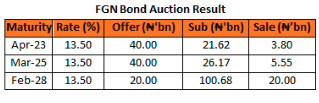

Bonds

The FGN Bond market traded on a significantly bullish note, with yields compressing by c.20bps following the 50bps cut in the MPR by the CBN in the previous session. The most demand was on the 10-Year bond which compressed by c.30bps and traded as low as 14.05% on the day, as market players speculated on a bullish outcome at the DMO’s bond auction.

Contrary to our expectations, the DMO cut rates significantly below current market levels (-70bps) and by 125bps from its previous auction levels down to 13.50% across all tenors offered. This came as a result of the N92bn sales to Non-competitive bidders on the 2023 and 2025 maturities. Only a total of N29.35bn was consequently sold of the total competitive bids of c.N148bn placed at the auction, indicating a competitive bid to cover ratio of 510%.

We expect the significant cut in the Auction stop rates to fuel a further rally in the bond market at tomorrow’s sessions, with yields however expected to gain support above the auction clearing rate of 13.50%.

Treasury Bills

The T-bills market traded on a relatively calmer note, with yields trending lower by c.15bps despite the c.50bps cut in MPR in the previous seesion. The most demand were witnessed on some mid tenor bills while the long end of the curve remained relatively flat as market players waited in anticipation of a possible OMO auction tomorrow, even as system liquidty remained relatively tight, with expectation for further debits and funding pressures.

We expect the market to trade in reaction to the possibility of an OMO issuance by the CBN. The market should trade slightly bearish if the CBN announces a renewed OMO auction with the 1-year bill still offer, whilst yields should compress lower if otherwise.

Money Market

Rates in the money market remained elevated as system liquidity remained relatively constrained at c.N65bn positive. The OBB and OVN rates consequently ended the session marginally lower at 15.14% and 15.50% respectively.

We expect rates to moderates slightly tomorrow, barring a significant OMO sale by the CBN.

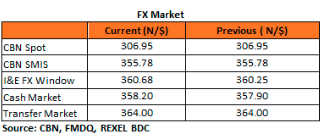

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window depreciated by 0.12% to N360.68/$, as market turnover fell markedly by 62% to $116m. At the parallel market, the cash rates depreciated by 0.08% to N358.20/$ whilst the transfer rate remained unchanged at N364.00/$ respectively.

Eurobonds

We witnessed renewed selloffs in the NGERIA Sovereigns in today’s session as prospects for weak global growth continued to fuel shifts away from EM into safe haven bonds. Yields consequently rose by c.12bps with most selloffs seen on the longer end of the curve.

In the NGERIA Corps, investor’s showed renewed interests in the ACCESS 21s, FBNNL 21s and ZENITH 22.

_________________________________________

Contact us:

Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com