Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Renewed Bullish Sentiments Anticipated Following MPR Cut

***CBN Switches Strategy, Cuts MPR by 50bps***

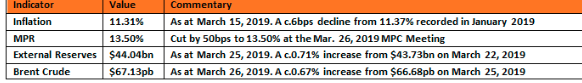

KEY INDICATORS

Macro

The Central Bank of Nigeria (CBN) at its Monetary Policy Committee (MPC) held at the banks’ headquarters in Abuja resolved to reduce the Monetary Policy Rate (MPR), by 50 basis points to 13.5 per cent from 14 per cent. The current reduction is coming after holding the MPR at 14% for 15 consecutive months since July 2016, when it was raised by 200 basis points to 14.0 percent. In its arguments, the Committee was convinced that a rate cut would further uphold the Bank’s commitment to promoting strong growth by way of encouraging credit flow to the productive sectors of the economy.

Bonds

The FGN Bond market traded on a quiet note, with slight demand witnessed on the 2028s towards the close of trading down to c.14.25%. Bids also strengthened on the 2023 bond, with yields closing relatively flat on the day due to slight uptick on the longer end of the curve.

The DMO will offer a total of N100bn of the 5, 7 and 10-yr maturities at an auction scheduled to hold tomorrow. We expect rates to trend lower as buying sentiments are expected to strengthen on the back of the 50bps cut in MPR by the CBN.

Treasury Bills

The T-bills market traded on a relatively flat note as buying interets were constrained by the relatively tight system liquidity levels. We consequently witnessed a slight uptick in yields on some mid and long tenor bills.

Barring a renewed OMO auction by the CBN, we expect rates to trend by c.20-30bps lower, as market players react to the MPR cut by the CBN.

Money Market

Rates in the money market moderated slightly as banks were able to access the CBN’s SLF for their funding needs, while system liquidity improved to c.N80bn positive. The OBB and OVN rates consequently ended the session at 16.43% and 17.29% respectively.

We expect rates to remain elevated tomorrow, as there are no significant inflows anticipated.

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window appreciated further by 0.04% to N360.25/$, as market turnover rose by 37% to $307m. At the parallel market, the cash and transfer rates remained unchanged at N357.90/$ and N364.00/$ respectively.

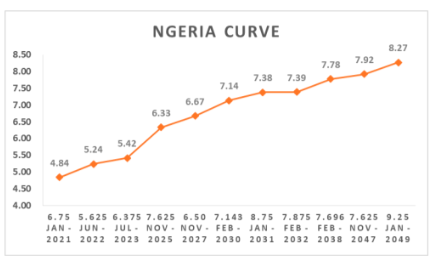

Eurobonds

The NGERIA Sovereigns were slightly stronger in today’s session, with yields compressing by c.5bps on the day, following renewed interests mostly on the longer end of the curve.

In the NGERIA Corps, investor’s remained bearish on the ECOTRA, ACCESS and FBNNL 21s, whilst demand remained firm on the FIDBAN 22s and SEPLLN 23s.

_________________________________________

Contact us:

Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com