The Board of Aluminium Extrusion Industries Plc has recommended the payment of a final dividend of 8.5 kobo per 0.50 kobo ordinary shares.

In a statement sent to the Nigerian Stock Exchange, the company also disclosed that the Register of Shareholders will be closed from Monday, June 17, to Friday, June 21, 2019. The qualification date has been slated for Friday, June 14, 2019.

Note that the payment date for the dividend payment is yet to be disclosed. The company’s shareholders will first need to approve the recommended dividend during the company’s AGM.

Understanding dividend

A dividend is a payment made by a company to its shareholders, usually as a distribution of profits. When a company earns a profit or surplus, it reinvests a portion of the profit in the business (retained earnings) whilst paying a portion as dividends to the shareholders.

Distribution to shareholders may be in cash (usually a deposit into a bank account) or the issuance of further shares, otherwise known as shares repurchase. But this is usually if the company has a dividend reinvestment plan.

In other words, a dividend is allocated as a fixed amount per share with shareholders receiving a dividend in proportion to their shareholding. For the joint-stock company, paying dividends is not an expense; rather, it is the division of after-tax profits among shareholders.

About First Aluminium Nigeria Plc

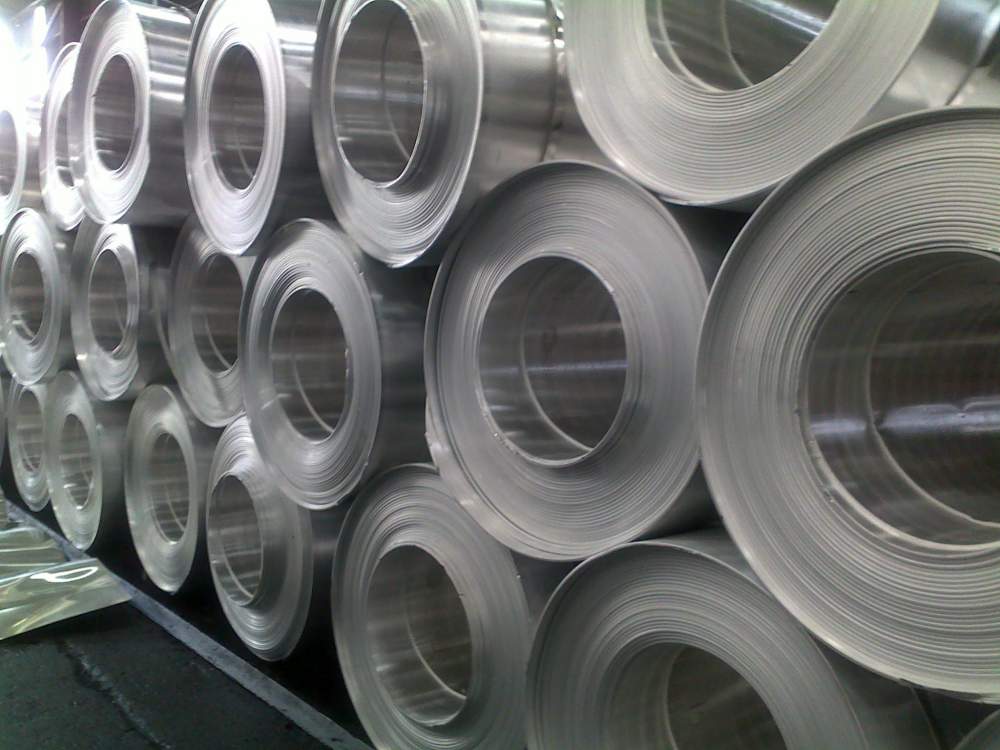

Aluminium Extrusion Industries Plc is one of the leading manufacturing company in Nigeria producing and marketing extruded aluminium products and coloured and wood products.

The company’s products include Cego flyscreens; projected window systems for institutions in the education, government, military and commercial sectors; amongst others.

Aluminium Extrusion has an annual capacity of 5 000 tonnes of aluminium extrusion products and produces profiles in a press finish, wood finish, silver and bronze colour palette and modern powder-coated forms.

The company has operations in Aba and Abuja to serve the eastern and northern regions of Nigeria. Its head office is in Imo State, Nigeria.

Aluminium Extrusion Industries Plc traded N8.20 in NSE’s last trading session.