The bond market remained scantily traded, with yields on the benchmark bonds trending

higher by c.6bps as demand interests remained relatively weak across the curve. The long

end of the curve witnessed some sell pressure as yields on the 2028 bond through to the

2037 bond rose by an average of 12bps.

The benchmark 10-year paper (2028) edged up 14bps to 14.39% as liquidity thinned out while the yield on the 2036 bond advanced by 18bps. Bonds traded volume worth N8.9 billion, lower than the N46.9 billion worth traded in the previous day.

The 2027 bond created the most value with trades worth N3 billion, followed closely by the 2037 maturity with trades worth N2.6 billion.

Tight system liquidity levels restricted interest

Trading in the t-bills market was equally quiet as buying interest was restricted by tight

system liquidity levels. Investors who requested for quotes did so to know the intention of

other investors rather than act on the quotes given.

Yields on the benchmark t-bills advanced by c.10bps. Notably, investors sold-off the 2nd –May bill (41 DTM) and pushed the yield up by over 100bps to a closing yield of 11.67%. In contrast, the 12th -September bill (174 DTM) recorded some buying activity as the yield on the bill slipped by 46bps while trade volume worth N32 billion was executed on the bill.

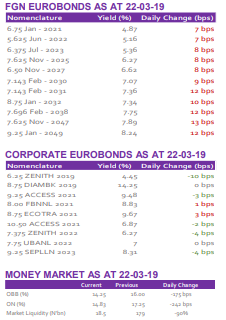

Interest and yield in the Sovereign Eurobonds

Interest in the Sovereign Eurobonds weakened marginally in Friday’s session and yields

climbed by c.10bps. Investors were spooked by concerns of an imminent global economic

downturn following the fall in the spread between the 3-month treasury bill yield and the

10-year note yield in the US to less than 1bp above parity. A thinner spread between both

benchmark yields suggests increased market expectations of a recession.

Money markets were down

At market close, money market rates were down by about 200bps apiece as the OBB and

O/N rates eased to 14.25% and 14.83% respectively. Liquidity in the interbank market was

estimated at N18.5 billion positive-a slump from N179 billion reported the previous day.

Liquidity levels shrunk on the back of the OMO auction as well as the retail FX auction.

Change in I & E Window Dynamics

The dynamics in the I & E window changed slightly in Friday’s session as there were more

buyers than people looking to sell the greenback. As a result the naira appreciated

marginally (0.01%) against the dollar in the I & E window and settled at N360.43/$

(Previous: N360.47/$).

Most offers ranged between N360/$-N361/$ although a few trades (25% of market turnover) happened at N359/$ levels. Most of the big banks were quiet as only one was willing to sell at N360/$ to the tune of US$5million. Turnover in the I & E window was estimated at US$231 billion, 67% lower than the previous day’s US$697 million. At the official market, the naira settled at N306.90/$.

A look at the week ahead

In the week ahead, we expect the naira to remain stable around N360/$ levels in the major

currency markets. In the fixed income market we anticipate a quiet open to the trading

week (Monday and Tuesday), regardless of the outcome of the MPC meeting, as we expect

the committee to retain monetary policy tools at current levels.

However from mid-week, we envisage volatile trading sessions through to the end of the week on the back of the bond auction scheduled for Wednesday, government revenue disbursals (FAAC) due month-end, OMO maturities worth N54 billion and funds that might be looking to book month-end profits.

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.