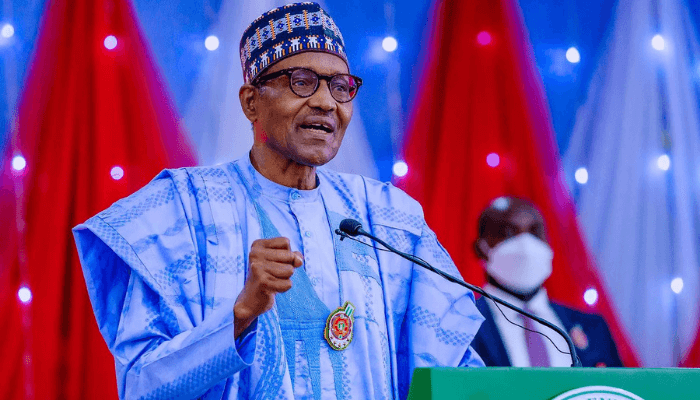

Nigerians’ collective sigh of relief over the possibility of finally getting an all-inclusive legislation on digital rights, was aborted on Wednesday when President Muhammadu Buhari declined assent to the Digital Rights and Freedom Bill.

Senate informed of the refusal through a letter: The President rejected the bill through a letter that was submitted to the Senate President and read during the legislature’s plenary session. Alongside the Digital Right and Freedom Bill, four other bills were also declined assent.

Why the President refused to assent: According to the presidency, the Digital Right and Freedom Bill was not assented because it contains too many technical subjects. It also did not extensively address any of the said subjects. Some of the technical subjects as highlighted by Presidency, include: surveillance and digital protection, lawful interception of communication, digital protection and retention, etc.

Why the Digital Right and Freedom Bill?

In today’s world, access to digital platforms influences most aspects of people’s lives and work.

With an internet penetration rate of 46%, Nigeria has the largest number of internet users in Africa, and 7th in the world. Hence, the need for a law that governs, protects, administers/enforces the digital human rights becomes important.

Also, as technology continues to shape and disrupt the global current landscape, measures must be put in place to ensure sanctity for the citizens.

If the Digital Right and Freedom Bill was signed, it would have catapulted Nigeria to the comity of nations leading the charge for the protection of digital rights and online freedom.

Basically, the Digital Right and Freedom bill is focused on protecting the rights of Nigerian online users. It also protects internet users in Nigeria from the infringement of their fundamental freedoms.

Technically, the bill’s objectives are:

- To guarantee the application of human rights offline and online within the digital space.

- To provide safeguards against abuse and provide opportunities for redress where infringement occurs.

- To ensure data privacy and safeguard sensitive citizens’ data held by government and privacy institutions.

- To equip the judiciary with the necessary framework to protect human rights online.

- To safeguard the digital liberty of Nigerians now and in the future.

Declined assent on bill a huge setback

Earlier, there have been pressures from activists and social groups for the president to approve the long-standing Digital Right and Freedom Bill, however, the President eventually declined to assent to the bill.

The Executive Director of Paradigm Initiative, Gbenga Sesan earlier remarked:

‘Signing the bill, President Muhammadu Buhari will “position Nigeria as a leader in rights-respecting law in Africa.”

Commenting on the Digital Right and Freedom Bill transmission, Web Foundation’s Interim Policy Director, Nnenna Nwakanma, said:

“This Bill is important right now, not only for the digital rights of Nigerians but as a signal that Nigeria intends to be a regional tech leader. We’re urging the National Assembly to put this forward to the presidency for signature as a matter of urgency so Nigerian web users can be protected in an online environment that guarantees them the same rights online as offline.”

The Nigerian Film Commission bill and three others were also declined assent

The President refused to append his signature to four other bills which include Nigeria Film Commission Bill, Immigration Amendment Bill, Climate Change Bill and Pension Practitioners of Nigeria Bill. The President cited several reasons why the other bills were also declined assents.

Buhari may be right, as earlier report already revealed the bill’s legal loopholes

According to the report by Doa-law firm in 2018, there were several surrounding issues to stall the bill. These include ambiguity and the utilisation of many undefined terms in the bill. For example:

- The use of “personal data” and “private data” interchangeably in various sections of the proposed legislation without defining them.

- Words such as “responsible party” require a more robust and comprehensive definition.

- The terms “service provider” is undefined by the proposed bill which added the tone of ambiguity to the section.

- Also, liability for a breach of data should be limited to such an extent that where a service provider has put in place reasonable security measures.

- Another frailty noted in the bill is the absence of any provision that addresses the obligations of Data controllers, Processor and Service provider.

- The law firm stressed that the passage of the bill without addressing issues highlighted would be to the detriment of the citizenry whose data would be the subject matter of such breach.

- It was concluded that the bill may need to e reconsidered as it does appear to be quite harsh and may need restructuring at the committee team.

Way forward, Activists sue the President

Rights groups, the Digital Rights Lawyers Initiative, and Laws and Rights Awareness Initiative have sued President Muhammadu Buhari at the Federal High Court sitting in Abuja for not signing the Digital Rights and Freedom Bill 2018.

They are seeking a declaration that, by virtue of Section 58(4) of the 1999 Constitution (as amended), the defendant lacks power “to remain silent and/or inactive” on the bill after 30 days of its transmission.

They are praying the court to declare that the President’s silence on the bill after 30 days of its transmission constitutes a violation of Section 58(4) of the 1999 Constitution.