Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

I&E Turnover Rebounds to c.$700m as CBN Re-Issues Long Tenor OMO Bill

***Nigeria’s Central Bank Sees Tight Monetary Policies Continuing*** – Bloomberg

Key Indicators

Bonds

The FGN Bond market traded on a relatively flat note, with yields marginally higher by c.2bps on the day. We however witnessed slight offshore interest on the 2028s which was the most actively traded bond during the session, with yields lower by c.10bps on the ticker.

We maintain a slightly bearish stance on the market, in view of the forthcoming FGN bond auction and reissuance of a long tenor OMO bill (14.90% eff. yield) by the CBN.

Treasury Bills

Yields in the T-bills market repriced higher by c.30bps as the CBN surprised the market with the re-issuance of a long tenor OMO bill in addition to its short and mid tenor offerings. The Auction was oversubscribed by c.238%, with the CBN eventually selling a total of c.N293bn of the N100bn offered. Stop rates were left unchanged on the 91-day bill while they declined significantly to 12.98% and 13.04% on the 182-day and 350-day bills respectively.

We expect the market to be largely driven by demand interests from lost out bids at today’s OMO auction. Barring a renewed OMO auction by the CBN, the market should trade on a slightly bullish note tomorrow.

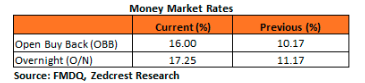

Money Market

Rates in the money market trended higher by c.6pct as the OMO auction by the CBN took system liquidity to an estimated negative position of c.N117bn from c.N176bn positive levels opening the day. The OBB and OVN rates consequently ended the session at 16.00% and 17.25% respectively.

We expect rates to remain elevated tomorrow, as there are no significant inflows anticipated.

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N305.90/$ (Spot) and N356.92/$ (SMIS). The NAFEX closing rate in the I&E window weakened slightly by 0.02% to N360.47/$, whilst the market turnover rebounded strongly to c.$700m due to renewed FPI inflows chasing the OMO offering by the CBN. The cash and transfer rates at the parallel market however remained unchanged at N357.80/$ and N364.00/$ respectively.

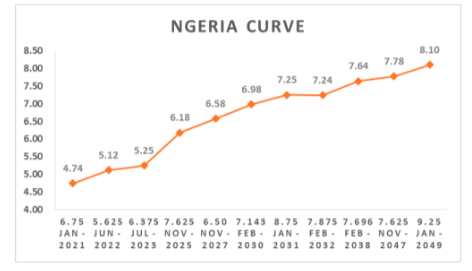

Eurobonds

The NGERIA Sovereigns rebounded strongly following the slightly more dovish stance by the US FOMC. Yields were consequently lower by c.7bps on the day, with the strongest gains witnessed on the mid to long end of the curve

In the NGERIA Corps, we witnessed slight interests on the Access 21s Sub and FIDBAN 22s

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.