The Nigerian National Petroleum Corporation (NNPC) has reported a trading surplus of ₦12.13billion in the oil and gas sector for December 2018. This is revealed in the Monthly Financial and Operations Report recently released by the corporation.

NNPC attributed the rise in revenue posted to the increased revenue generated by the corporation’s Upstream subsidiary — the Nigerian Petroleum Development Company (NPDC). The NNPC’s monthly report cited NPDC’s continuous revenue drive, which resulted from the recent average weekly production of 332,000 barrels of crude per day, as the main driver of the positive outlook.

Basic Highlights

- Total revenues generated from the sales of white products stood at ₦2.8 trillion year-on-year December 2018

- Sales of Premium Motor Spirit (Petrol) contributed 89.63% of the total sales with a value of ₦2.5 trillion

- In terms of value, ₦2.4 trillion was made on the sale of white products by PPMC in December 2018, compared to ₦1.46trillion sales in November 2018.

- Overall, during the month under review, 1.96billion litres of white products were distributed and sold.

- In the gas sector, natural Gas production increased by 12.22% at 240.64 billion cubic feet translating to an average daily production of 8,021.21mmscfd.

- The daily average natural gas supply to gas power plants hiked by 5.36% to 774mmscfd, equivalent to power generation of 3,131MW.

Petrol supply inch up as NNPC supplied 1.80billion litres in December

The NNPC report shows that the volume of Petrol supplied in December was 1.80billion litres, translating to 58.17m liters/day.

Overall, during the month under review, 1.96billion litres of white products were distributed and sold by NNPC Downstream subsidiary, Petroleum Products Marketing Company (PPMC), compared with 1.09billion litres in the market in the November 2018.

The break down of the 1.96billion litres of white product supplied reveals that 1.94billion litres were petrol, 0.0070billion litres of kerosene and 0.014billion litres of diesel.

Total sale of white products for the period, December 2017 to December 2018, stood at 21.84billion litres and Petrol accounted for 20.17billion litres or 92.36%.

Gas production up by 2.22%

In the gas sector, natural Gas production increased by 12.22% at 240.64 billion cubic feet compared to output in November 2018; translating to an average daily production of 8,021.21 million standard cubic feet per day (mmscfd). The daily average natural gas supply to gas power plants rose by 5.36%.

Out of the 240.59bcf of gas supplied in December 2018, a total of 151.13 billion cubic feet (bcf) of gas was commercialized, consisting of 38.61bcf and 112.52bcf for the domestic and export market respectively.

This translates to a total supply of 1,245.48 mmscfd of gas to the domestic market and 3,748.47 mmscfd of gas supplied to the export market for the month, implying that 62.61% of the average daily gas produced was commercialized while the remaining 37.39% was re-injected, used as upstream fuel gas or flared.

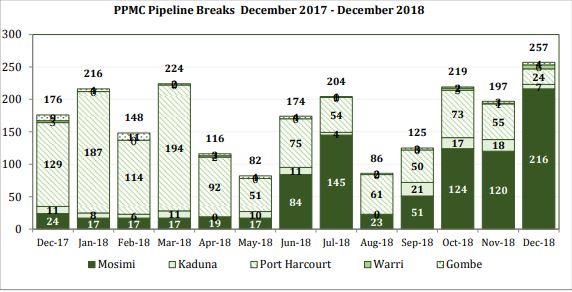

Pipeline Vandals rose by 34%

There appears to be no end in sight in the activities of vandals in the oil and gas sector. For instance, in December 2018, pipeline breaches across the Country rose by a whopping 34% point, NNPC Group General Manager, Group Public Affairs Division, Mr. Ndu Ughamadu, stated this in a release Sunday in Abuja.

“The upward swing in the breaches was captured in the corporation’s Monthly Financial and Operations Report for December, 2018, explaining that within the period, 257 pipeline points were vandalized, out of which one pipeline point failed to be welded and six pipeline points were ruptured.” -Uche

Similarly, Gas flare rate was 9.15% for the month under review i.e. 729.55mmscfd compared with average Gas flare rate of 9.92% i.e. 777.37mmscfd for the period December 2017 to December 2018.

NNPC recorded 197 Pipeline breaches as Ibadan tops

Ibadan-Ilorin, Mosimi-Ibadan, and Atlas Cove-Mosimi networks accounted for 90, 69 and 57 compromised points respectively or approximately 34%, 26 % and 22% of the vandalized points respectively.

Aba-Enugu pipeline link accounted for 7% with other locations accounting for the remaining 11% of the pipeline breaks.

Despite vandals, sales revenue from white products inches up

The Monthly Financial and Operations Report shows that NNPC posted a trading surplus of ₦12.13billion in December last year, a leap from recent past performances.

In terms of value, ₦241.46billion was made on the sale of white products by PPMC in December 2018, compared to ₦146.56billion sales in November 2018.

Total revenues generated from the sales of white products for the period December 2017 to December 2018 stood at ₦2.77trillion, with Petrol contributing about 89.63% of the total sales with a value of ₦2.49 trillion.

Going forward, the NNPC reiterated that despite the disturbing reports of breaches on its assets, the corporation, on the whole, posted a positive outlook in December 2019.