Guaranty Trust Bank published its full-year 2018 financial result yesterday. While net profits came in 1% below our expectations but in tandem with market expectations, net income increased 10% year-on-year to N184.6bn (US$513m).

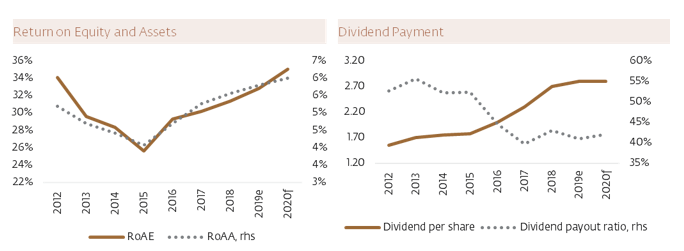

The tier-1 bank proposed a total dividend of N2.75 per share which (inclusive of an earlier interim dividend of N0.30/s) translates to a total gross dividend yield of 6.0%. The current 1-year T-bill yield is 15.02%).

We maintain our Hold recommendation.

A closer look at the result

Net interest income was down 10% year-on-year due to a combination of 13.1% lower loan balances and the net interest margins which declined to 10.8% (2017: 11.4%).

Fee income was strong, up 24% year-on-year, largely on account of a strong growth in electronic business income (+28.3% y/y) and commission on foreign exchange deals (+81.5%y/y). We have some questions about the sustainability of this line.

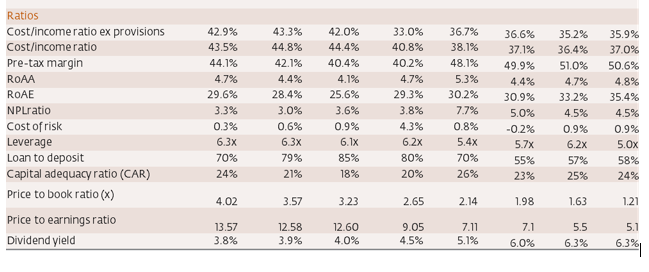

Asset quality has gradually improved with Non-performing loans (NPL) trending down from 7.66% at FY 2017 to 5.67% at FY 2018, approaching the prudential thresholds of 5.00%. Loan loss provisions were also down 60% y/y relative to FY 2017.

Expenses ticked up by 1% y/y, as the bank was able to manage its costs through a significant reduction in finance costs and communication expenses. This increase was sub-inflationary. The average level of inflation in 2018 was 12.15%.

The bank reported 9% growth in pre-tax profits and 10% growth in net profits.

GT Bank is well-known for being highly profitable and efficient, the bank’s return on assets (ROA) and return on equity (ROE) profitability metrics came in at 30.9% and 4.4%, respectively, one of the highest in Nigerian banking industry. GT Bank has also paid an increasing quantity of dividend to its shareholders y/y. Consistency is the key point of comfort for us with GTBank.

With a total capital adequacy ratio of 22.5% at FY 2018, the bank remains in a strong capital position compared with the regulatory minimum of 16% despite the adjustment for the full impact of IFRS 9. This provides the bank latitude to grow its risk assets in 2019, and in turn improve its interest income. However, given continued slow economic development, we think the prospects for loan growth are moderate at best. We are looking for 11.0% nominal loan growth in 2019e.

We have a price target of N35.0/s for GT Bank and given the potential downside relative to current price of N37.95/s, we maintain our Hold rating on the stock