Sovereign Trust Insurance, a penny stock on the Nigerian Stock Exchange, has performed poorly in terms of profitability in the last few years. While management has taken steps to turn the company around, benefits will not appear in the short term.

Sovereign Trust Insurance is this week’s STOCK PICK.

About the company

Sovereign Trust Insurance commenced business on the 2nd of January, 1995 with an authorized share capital of N30 million and fully paid up share capital of N20 million, following the acquisition of Grand Union Assurance Limited.

The company became a public limited company on 7th April 2004 and was listed on the Nigerian Stock Exchange (NSE) on the 29th of November, 2006.

Recent results: Results for the nine months ended September 30, 2018 show that gross premium written increased from N7.3 billion in 2017 to N9.3 billion in 2018. Profit before tax dropped from N716 million in 2017 to N601 million in 2018. Profit after tax also fell from N667 million in 2017 to N543 million in 2018.

Pricing

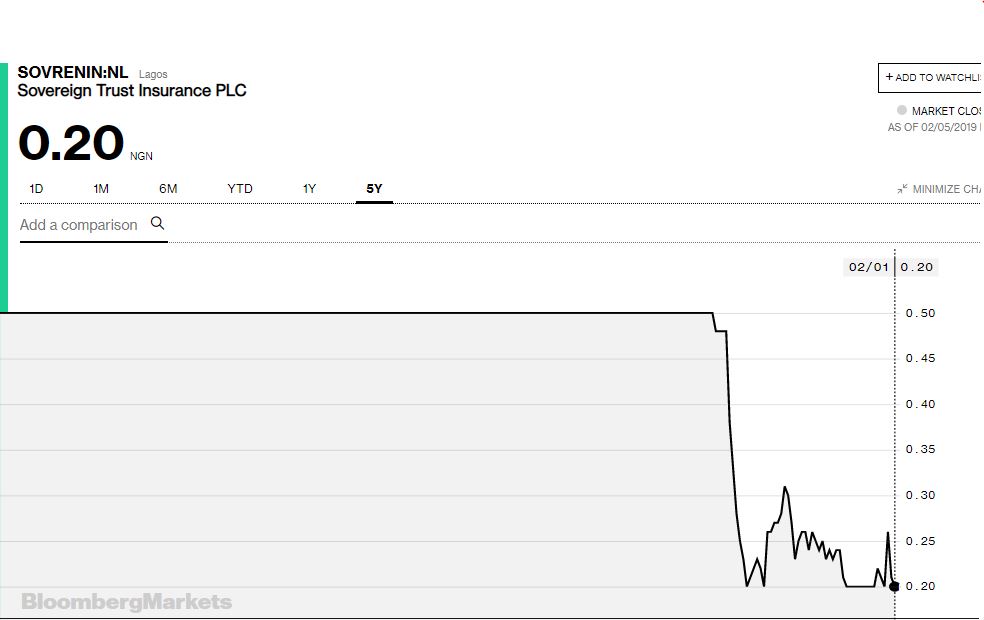

Current Share Price: N0.20

Year High: N0.26

Year Low: N0.20

Year to Date: –4.8%

One Year Return: -58.33%

Price Outlook

The stock will most likely continue to trade at its current region, in the absence of any major news. 9M 2018 results show a decline in both top line and bottom line; an indication that Sovereign Trust Insurance may have a flat full-year 2018 result or a mild decline.

The company’s share price has been stagnant in the last 5 years, before tumbling to N0.20 when a new minimum price floor was introduced by the Nigerian Stock Exchange (NSE).

For investors that have held the stock for the last 10 years, the erosion in value is much more. Investors that got into the stock, when it was trading as high as N5.98 in 2005, and held till date, have lost about 96.6% of their value.

Valuation

Sovereign Trust Insurance is trading at a PE ratio of 66 times earnings, nearly 10 times higher than the average PE ratio on the NSE.

Outlook

While the company may take pride in record claims paid, shareholders have not benefited from holding the stock in the last few years.

Dividend payment has been absent due to negative retained earnings, while the slump in share price has caused erosion of value for shareholders.

Last month, the insurance firm received the approval of the NSE for a rights issue of 4,170,411,648 ordinary shares of N0.50 each at N0.50 per share on the basis of 1 new ordinary share for every 2 ordinary shares held as at 15 January 2019.

Investors would be better off waiting for the company to have positive retained earnings before taking a position.