Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, forex, inflation, oil price.

- FGN Bond auction undersubscribed by 11% amidst weak investor appetite

- Headline year-on-year (YoY) Inflation falls to 11.26% in October, compared to 11.28% in September

KEY INDICATORS

Bonds

The FGN bond market was scantily traded as market participants focused on the outcome of the Bond auction floated by the DMO today. While spreads in the market adjusted closer amidst bearish sentiments, yields consequently ticked marginally higher by c.1bp on the average across the curve.

The FGN Bond Auction conducted by the DMO today was undersubscribed, with an 89% bid to cover, showing weak investor appetite towards the auction. The DMO was only able to raise a total of c.N39bn out of the N115bn on offer as investors demanded for higher yields. Stop rates ticked higher than the previous auction to close at 15.20% (20bps higher) for the 5-yr, 15.50% (35bps higher) for the 7-yr and 15.83% (51bps higher) for the 10-year papers.

We expect market to remain risk-off on bonds in the interim, as investors look to fill demands for higher yields at the next auction which comes up in 3-weekstime.

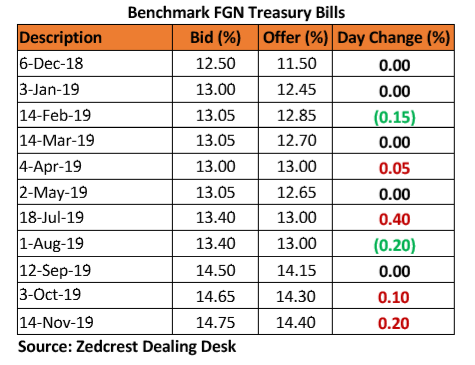

Treasury Bills

Trading activity picked up in the T-bills market after the break, albeit with a bearish bias. We witnessed sell-offs from local and foreign participants along the mid- to long-end of the T-bill curve, as the final MPC meeting of the year commenced today. Yields consequently expanded by c.8bps across the T-bills curve, with the 03-Oct-2019 maturity hitting an intraday high of 14.80%.

With supply expected via an OMO auction tomorrow, we maintain our expectations for yields to trend upwards for the rest of the week.

Money Market

Money Market rates moderated a little today as there were no major inflows/outflows hitting the banking system. The OBB and OVN dropped by c.0.33bps to close at 9.67% and 10.67% respectively, as system liquidity remained stable at c.N250bn.

We expect rates to further drop tomorrow due to inflows of c.N408bn coming from OMO T-bills maturities. The CBN is however expected to mop up excess liquidity from the system through the sale of OMO T-bills to moderate inflationary pressures.

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.75/$ (spot) and dropped by c.N1.04k to close at N360.85/$ (SMIS). At the I&E FX window a total of $348.02bn was traded in 220 deals, with rates ranging between N360.00/$ – N365.00/$. The NAFEX closing rate appreciated by c.0.16% to N364.26/$ from N363.69/$ previously.

At the parallel market segment, the cash and transfer rates both remained unchanged to close N364.00/$ and N366.50/$ respectively.

Eurobonds

The NGERIA Sovereigns continued to underperform amongst its Sub-Saharan Africa peers due to the recent bearish oil market and general election sentiment. We saw little interest on the NGERIA 27s and 49s as flows reduced ahead of the U.S. Thanksgiving bank holiday set for tomorrow.

Similarly, we witnessed little interest across major NGERIA Corps tickers. The DIAMBK 19s bond holders were also credited coupon today. We believe this should spur more buying interest going forward as the yield on the bond remains the most attractive amongst its peers.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.