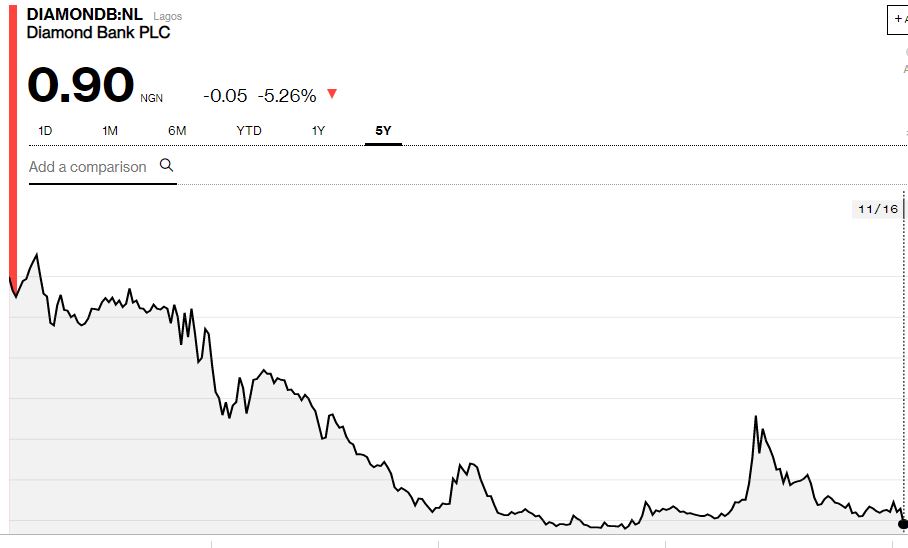

Diamond Bank Plc

Diamond Bank, in addition to hitting a 5-year low, was the worst performing stock last week. The stock hit a 5-year low of N0.86, last week Thursday and eventually closed on Friday at N0.90, down N0.38 or 29.69%.

Year to date, the stock is down 40%.

Why the stock may have slumped

The bank has been in the proverbial bull’s eye in the last couple of weeks. First, about speculation that the bank was one of three allegedly with poor liquidity ratios, flagged in a half year report by the Central Bank of Nigeria.

Next was unconfirmed media reports that tier one lender, Access Bank Plc, was reportedly interested in acquiring the bank. Both banks have since debunked the claims.

An investor call following the bank’s 9 months results for the period ended September 30, 2018, which would have provided more clarity about the bank, has been postponed.

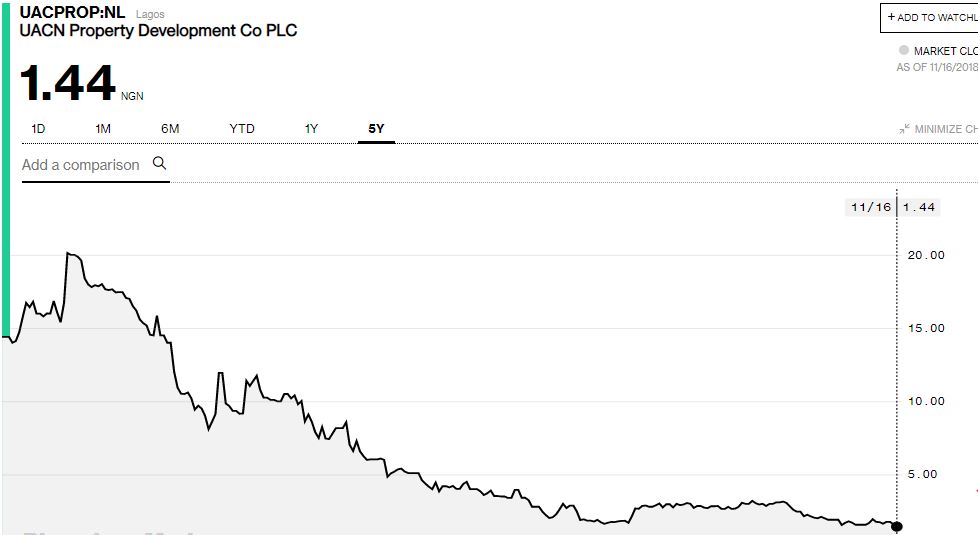

UPDC

UAC Property Development Company Plc also hit a 5-year low last week.

The stock opened at N1.60 and closed at a 5-year low of N1.44 on Friday, down N0.16 or 10%.

Year to date, the stock is down 48.39%.

Likely reasons the stock has been on a free fall

UPDC has had a poor string of results and may end the 2018 financial year on a poor note.

Results for the nine months ended September 30, 2018, show that revenue fell from N3.1 billion in 2017 to N1.9 billion in 2018. Loss before tax jumped from N1.9 billion in 2017 to N4.5 billion in 2018. Loss after tax stood at N4.7 billion in 2018, as against N2.2 billion in 2017.

The company has made efforts to come round, but they are yet to yield fruition.

Fola Aiyesimoju was appointed as Chief Executive Officer (CEO) of UPDC. Aiyesimoju is a partner with Themis Capital which took up a significant stake in UAC in April this year.

The company’s poor Q3 2018 results have been largely due to a recession in the real estate sector and impairment of receivables as stated in the parent company’s Q3 2018 press release.

“Continued recession in the Nigerian real estate market led to a markdown of the carrying value of JV projects and impairment of related receivables. Investment property sales realised below book values resulted in an operating loss in the third quarter.”

The company’s poor fortunes have also taken a toll on the parent company, UAC of Nigeria Plc. UACN hit a 5 year low of N11 in September and has since fallen much lower.