Flour Mills of Nigeria Plc. (FMN) Group, the market leader in food and agro-allied products in Nigeria, today announces its unaudited half year results for six months ended 30th September 2018.

Key Highlights

Group

- The Group increased its market share in some product categories, in a somewhat

challenging environment with lower consumer spending. The Group’s Revenues were

N269.74 billion, compared to N298.44 billion of the same period last year, with an increase in the Group’s share of the market. - The Group recorded a 49% increase in selling and distribution expenses of N4.13 billion,

compared to N2.77 billion of the same period last year, as it increased its marketing

spend. - The Group recorded a growth in investment income of N290 million, a 6% increase

when compared to N270 million of the same period as last year. The increase being

attributed to short term investments. - The Group recorded a notable drop in its finance cost from N16.27 billion in Q2, 2017 to

N11.23 billion in Q2, 2018. A 31% drop which is due to settlement of overdraft facilities

and replacement of high interest yielding loan facilities with cheaper loan facilities.

Flour Mills of Nigeria Plc (The Company)

- The Company, Flour Mills of Nigeria Plc recorded a revenue of N202.92 billion, compared

to N216.77 billion of the same period last year. The 6% reduction in revenue is mainly due

to a minor drop in sales volume which is precipitated by the persistent traffic challenges

in Apapa. - Administrative expense was N7.55 billion, compared to N5.87 billion in the same period

as last year. The 29% increase is mostly driven by increase in employee cost and other

general expenses.

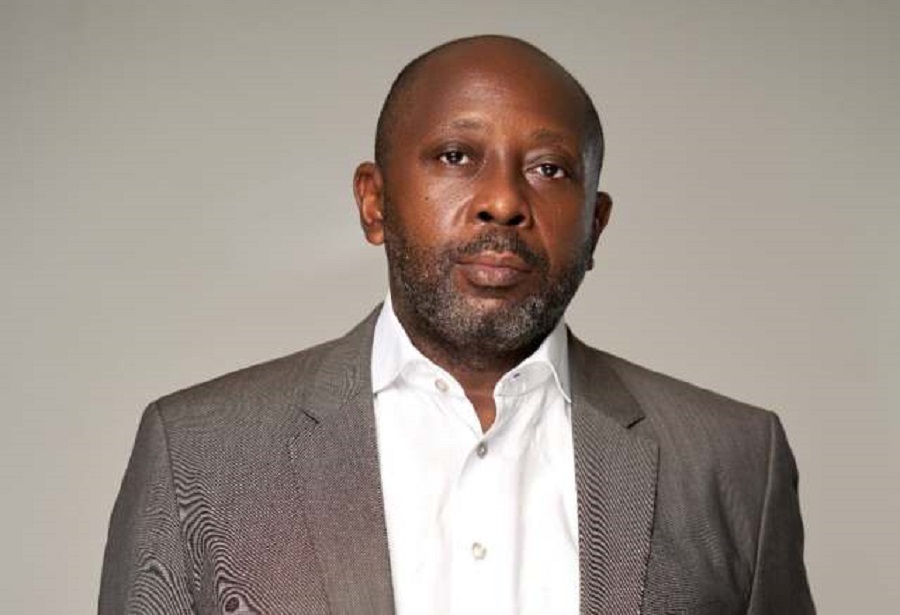

Commenting on the result, Paul Gbededo, the Group Managing Director said:

“In the face of persistent economic challenges and a difficult operating terrain, we continue

to pursue our growth strategy to gain market share in all key product segments. Operations in Apapa continues to suffer major setbacks in traffic and logistics challenges, impacting in a marginal drop in our volume and top line activities.

With improved marketing and promotional activities for most of the key food businesses, we envisage new gains in the remaining part of the year, as we continue to focus on innovative products that deliver on great consumer experience.”

About Flour Mills of Nigeria Plc

Incorporated in September 1960 and quoted on the Nigerian Stock Exchange since 1978, Flour Mills of Nigeria (FMN) Plc. is one of Nigeria’s leading food and agro-allied companies. With a broad basket of food products, an iconic brand “Golden Penny” and a robust pan-Nigerian production, distribution, and supply chain network, FMN is a fully integrated and diversified food and agro-allied group.

The FMN group strives in its mission to “Feed the Nation, Everyday” through its five core food

value chains: Grains, Sweeteners, Oils and Fats, Proteins, and Starches. FMN creates value

along the entire food chain with its “farm-to-table” model by providing inputs and know-how to farmers, aggregating and sourcing crops and raw materials to supply its world-class

processing facilities across Nigeria, and distributing its innovative food brands to its customers.

More information can be found at www.fmnplc.com

Follow FMN, on Facebook, Instagram, LinkedIn, Twitter and YouTube