Today on Nairametrics’ company focus, we shall be looking at one corporate entity whose business model is literally all about caring for your wellbeing. Ekocorp Plc is one of the biggest private healthcare providers in Nigeria, and the only one to have its shares listed on the Nigerian Stock Exchange (NSE). However, being known mainly as Eko Hospitals means that not everyone knows about this company. For this reason, it is one of the least popular companies that are listed on the Nigerian bourse.

This article is intended for prospective investors looking for where to put their money, as well as the curious reader who is simply interested in knowing more about Nigerian companies and corporate environment. Let us let you in on everything about the history, business model, management, ownership structure, competition, recent financial reports, and investments prospects of Ekocorp Plc. Most importantly, we shall be analysing the company’s financials to see if it is still making money, as it is yet to release any quarterly result so far in 2018.

About Ekocorp Plc: 36 years of healing Nigerians

The history of Ekocorp Plc can be traced back to 1982, when three medical practitioners – Dr. Alexander Eneli, Dr. Sunday Kuku, and Dr. Augustine Obiora – decided to pool resources together in a merger which birthed Ekocorp Hospital Limited.

As a joint medical practice, Ekocorp was designed to function as both a medical centre and a teaching hospital. This is interesting considering the fact that in Nigeria such hospitals are usually state-owned, with examples including the likes of University College Hospital (UCH), Ibadan and Lagos State University Teaching Hospital, Ikeja.

In 1991, the company was re-registered as a Public Limited Liability Company, Plc. The name was formerly changed to Ekocorp Plc in 1994. It is primarily concerned with the delivery of healthcare, as well as medical research. The hospital has three branches in Lagos which are strategically located in Ikeja, Surulere and Ikoyi.

One thing worth noting is the origin the hospital’s brand name (Eko). According to information made available by the company, “EKO” signifies “the first letters of the three founders’ surnames in alphabetical order – “E” for Eneli, “K” for Kuku, and “O” for Obiora.” This is contrary to the general belief that the “Eko” in Ekocorp Plc signifies the traditional name for the city of Lagos which, coincidentally, is also “Eko”.

A look at the specific services offered by Ekocorp Plc

As a fully-fledged healthcare company primarily concerned with ensuring the well-being of millions of Lagosians, it is not surprising that Ekocorp Plc offers a wide array of medical services, which are listed below:

- General Medicine

- Cardiology

- Paediatrics

- Orthopaedics

- Dialysis

- Neurology

- Obstetrics and Gynecology

- Intensive Care

- Clinical Oncology, and

- General Surgery

The company’s target market

The hospital caters to the general wellbeing of Nigerians, specifically those who reside in Lagos. However, it should also be noted that as one of the leading private hospitals in the country, its high price makes it nearly impossible for the average Nigerian to seek medical healthcare here. That said, the company’s target market can, therefore, be narrowed down to the relatively wealthy and middle-class Nigerians who can afford their services.

A look at the company’s ownership structure

Ekocorp Plc is 100% owned by Nigerians. According to information contained in the company’s full-year 2017 financial report, notable shareholders include:

- Geoff Ohen Limited: This entity owns a total of 265,198,960 units of shares which translates to some 53.19% majority shareholding.

- Estate of Eneli (Chief) Alex C. owns some 56,370,485 units of shares which represents 11.31%.

- Dr. Amechi A. OBiora, (FRCS) owns 56,370,485 units of shares, representing 11.31%.

- Dr. Sunny Folorunso Kuku (OFR, FAS) owns 56,370,485 units of shares, also representing 11.31%.

Note that a portion of the company’s shareholding has for a long time been the subject of a protracted legal dispute, the details of which will be discussed shortly.

These are the members of the company’s Board of Directors

The following individuals serve in various capacities as members of the company’s board of directors:

- Dr Sony Folorunso Kuku, OFR, FAS – Chairman

- Dr Amaechi A. Obiora FRCS – Alternating Chairman

- Dr O.A. Odukoya – Chief Medical Director/CEO

- Prof J.O. Irukwu, OON, SAN – Director

- Senator M.N.I. Ajegbo, CON – Director

- Pastor S.O. Nathaniel – Director

- Dr G.C. Ohen, Jr. FAGP – Director

- Mr. Olusegun Olusanya – Director

A look at the company’s competitors

Just as in the case of virtually every business, Ekocorp Plc has to deal with competitors who are scrambling daily for market share. These competitors range from general/teaching hospitals to smaller private hospitals. That said, the company’s biggest competitors are the equally well-established and big private hospitals which target the same market audience. Examples of these hospitals are Reddington Hospital, Lagoon Hospital, St Nicholas Hospital, Parkland Hospital, First Consultants Hospital, etc.

The company has been embroiled in a legal dispute

Back in 2014, an article published by one of the leading national dailies claimed that an internal legal dispute was threatening the corporate existence of Ekocorp Plc. This claim was later acknowledged in the company’s 2017 financial disclosure, although without much details. Meanwhile, Nairametrics also confirmed that the dispute boils down to a fierce battle over majority shareholding in the company.

Apparently, a new majority shareholder had emerged in the person of Dr Geoffrey Ohen. Shortly after his emergence, the initial founders of the company accused him of “surreptitiously” acquiring the company’s shares in a bid to become a shareholder.

The founders also alleged that Dr Ohen’s emergence as majority shareholder never augured well for the company. This is because his dealings allegedly exposed the company to financial losses, resulting in the company’s inability to pay the founders a combined total of N112 million which they were owed.

Note that this court case is still unsettled, and Dr Ohen remains the company’s majority shareholder.

The company’s pending financial results for 2018

Ekocorp Plc is yet to release financial statements for the first, second and third quarters of 2018. Attempts by Nairametrics to find out why this is the case proved abortive. This situation makes us wonder whether or not the company has been making money this year. Bear in mind that the most recently disclosed financial statement by the company is for full-year 2017. And even before the report was released, the NSE had to threaten to impose sanctions.

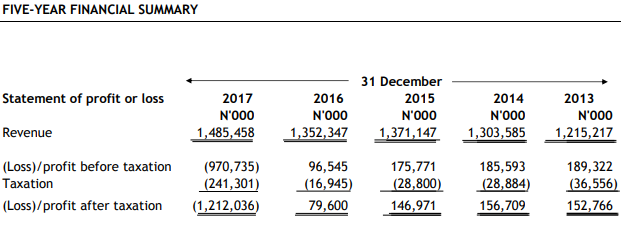

Meanwhile, the 2017 financial report shows that while the company’s turnover stood at about N1.4 billion, it recorded a staggering loss after tax of N1.2 billion. This is the worst performance for the company in over five years as you can see in the table below.

The company’s Chairman agreed that it was an abysmal performance, stating that, “2017 was a relatively difficult year due to the effects of macroeconomic factors such as increased inflation and foreign exchange imbalances which led to increased operating costs.”

In conclusion…

Ekocorp Plc should quickly resolve its internal legal disputes in order to focus on the most important task which is delivering quality healthcare services. This is very important, as it is the only way to ensure that the company remains profitable, while competition stiffens.