Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bargain Hunt on Short Tenors Bills ahead of PMA

Inflation Rises Marginally to 11.28% in Sept. 2018 – NBS

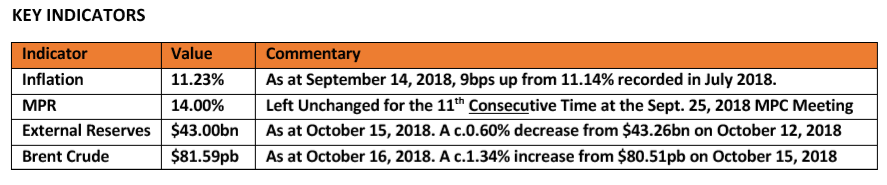

KEY INDICATORS

Bonds

The bond market remained relatively flat in today’s session, with only slight buys seen on the 2028s which compressed yields marginally by c.1bp on average. This came on the back of a softer than expected inflation figure for the month of September, which ticked marginally higher by c.5bps on the back of rising food costs.

We expect the market to remain range bound in the near term, as market players are expected to maintain a relatively risk off stance ahead of the forthcoming Bond Auction.

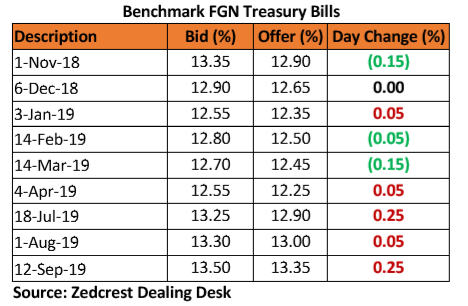

Treasury Bills

The T-bills market was generally slightly bearish, with yields ticking higher by c.15bps on the back of expectations for the PMA tomorrow. We however noted signifcant demand for bills on the shorter end of the curve (Jan maturities), as market players priced in expectations for lower clearing rates on the tenor at tomorrow’s PMA.

Due to the relatively tight level of system liquidity, and expectations for a possible supply of the PMA bills at the next day’s OMO, we expect rates at the auction tomorrow to clear slightly above their previous levels.

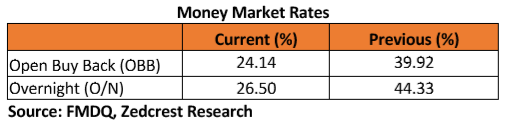

Money Market

The OBB and OVN rates, though declining slightly, remained elevated at 24.14% and 26.50% respectively, as system liquidity is estimated to be much unchanged from its opening levels of c.N50bn positive.

We expect rates to remain to remain slightly above the 20% mark, as there are no significant inflows expected tomorrow.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.45/$ (spot) and N362.52/$ (SMIS). At the I&E FX window a total of $198.71mn was traded in 367 deals, with rates ranging between N360.00/$ – N365.50/$. The NAFEX closing rate depreciated by c.0.11% to N364.33/$ from N363.92/$ previously.

At the parallel market, the cash rate depreciated by 20k to N360.20/$ while the transfer rates remained unchanged at N363.50/$.

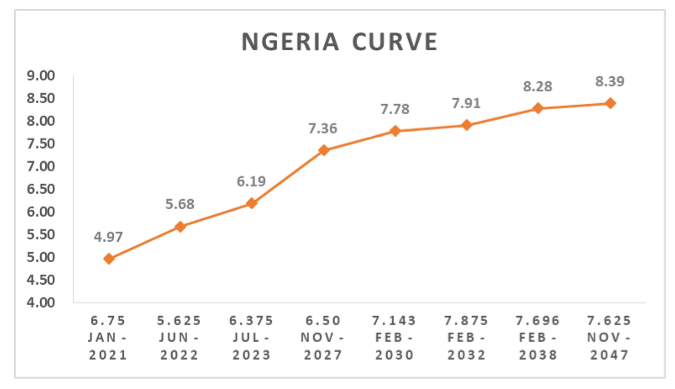

Eurobonds

The NGERIA sovereigns remained firmly in positive territory, with yields compressing further by c.4bps as investors continued with the recent bargain hunting across most of the maturities.

There were no noteworthy trades for us in the NGERIA Corps, except for mild axes on the FIDBAN 22s (sell) and SEPLLN 23s (buy).

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.