Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

CBN Mops up System Liquidity in c.N553bn OMO Sale

Nigerian Eurobonds Bleed Amid Spike in US Treasuries

KEY INDICATORS

Bonds

Yields in the bond market compressed marginally by c.1bp, with slight buying interests still evident on select maturities during the day. We however note the peculiar support for the longer term yields at c.15% in the past three sessions starting the new month, with trades done as low as 15.001%, but no lower.

Despite the recent successes by the DMO at its past FGN Bond and NTB Auctions, market players remain skeptical of the yet to be released Q4 FGN Bond calendar, with expectations of a higher level of planned borrowings compared to Q3. We are also expecting a second tranche of the FGN Sukkuk Bonds to be announced shortly.

Treasury Bills

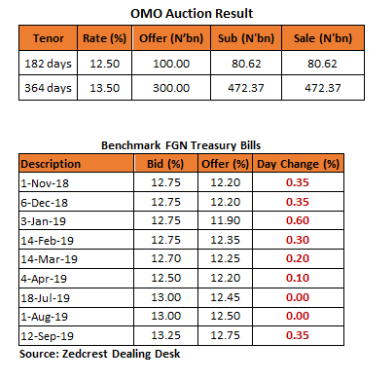

In line with our expectations, yields in the T-bills market trended higher by c.10bps as the CBN floated an OMO Auction to mop up excess inflows from maturing bills. The OMO was met with signifcant demand of c.N553bn of the N400bn offered. The CBN consequently sold to all subcribers, with rates maintained at 12.50% and 13.50% on the 182 and 364-day bills respectively.

We expect yields to close the week on a relatively calm note, with buying interests relatively quietened by the signifcant OMO sale today.

Money Market

The OBB and OVN rates shot above single digits to close today at 11.67% and 12.58% respectively, as the CBN mopped up c.N553bn off system liquidity via an OMO Sale. System Liquidity is consequently estimated at c.N120bn positive, with inflows form OMO maturities (c.N268bn) providing some cushion for rates in the market.

We expect rates to remain relatively unchanged tomorrow, as there are no significant outflows expected.

FX Market

At the Interbank, the Naira/USD rate remained stable N360.40/$ (spot) and N361.34/$ (SMIS). At the I&E FX window, the NAFEX closing rate appreciated further by c.0.06% to N363.57/$ from N363.78/$ previously. At the parallel market, the cash and transfer rates remained unchanged at N359.50/$ and N362.00/$ respectively.

Eurobonds

The NGERIA sovereigns turned bearish in today’s session, with yields trending higher by c.10bps on average, amid a continued spike in the US treasury rates (NB: 10yr UST @ 3.19%). The 30-yr bond was the most hit, down by c.2.00pct in price terms on the day.

Market Players were also slightly bearish on the NGERIA Corps except for slight gains on the FIDBAN 22s. We witnessed slight retracements on the SEPLLN 23s and ACCESS 21s snr, and slight selloff on the GRTBNL 18s and ZENITH19s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.