Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

Seplat Eurobond Surges amid Uptrend in Oil Prices

Nigeria’s foreign reserve still strong – CBN

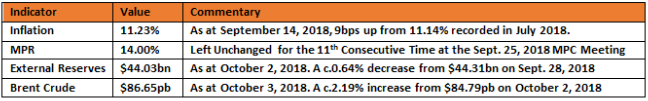

KEY INDICATORS

Bonds

The Bond Market remained slightly bullish in today’s session with demand shifting towards the longer end of the curve, where market players bought down the 2034s as low as 15.02%. Other maturities remained scantily traded, with yields compressing marginally by c.3bps on average.

We expect the mild bullish sentiments to persist in the near term due to the sustained interests from local investors in the market. We however note that yields have remained relatively well supported at c.15% on the mid to long end of the curve (27s – 37s).

Treasury Bills

The T-bills market was relatively flat for most of the day, with yields just compressing marginally by c.3bps, as market players awaited results from the PMA. We witnessed some late rally however on the 19-Sep maturity folowing rumour of a signifcantly strong demand at the auction.

The Demand at the PMA was signifcantly robust, as all tenors with the exception of the 91-day well oversubscribed by market players. Rates consequently trended downwards by c.18bps avg. from their previous auction level, with rates clearing at 10.90%, 12.10% and 13.33% on the 91, 182 and 364-day bills respectively.

We expect yields in the secondary market to trend slightly higher tomorrow, due to expectations for an OMO auction by the CBN.

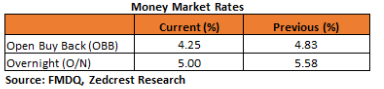

Money Market

The OBB and OVN rates declined slightly, closing today at 4.25% and 5.00% respectively, as system liquidity remained significantly robust at c.N400bn positive.

We expect rates to remain stable tomorrow, with inflows from OMO maturities (c.268bn), expected to provide a cushion for any outflows from the expected OMO sale by the CBN.

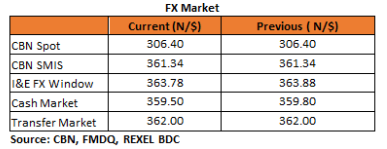

FX Market

At the Interbank, the Naira/USD rate remained stable N360.40/$ (spot) and N361.34/$ (SMIS). At the I&E FX window a total of $392.90mn was traded in 401 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate appreciated further by c.0.03% to N363.78/$ from N363.88/$ previously.

At the parallel market, the cash rate appreciated by 30k to N359.50/$, while the transfer rate remained unchanged at N362.00/$.

Eurobonds

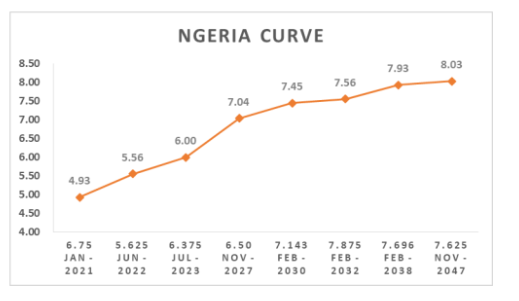

The NGERIA Sovereigns recovered some gains in today’s session, with yields trending slightly lower by c.3bps on average. Most gains were seen on the longer end 27s – 47s which gained c.0.50pct in price on the day.

The NGERIA Corps were mostly quiet, except for further gains seen on the SEPLLN 23s, which gained another c.0.45pct on the day, marking a c.1pct gain in the last two sessions and now trading 101/102, with last trade at 101.25.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which