***CBN revokes licenses of 182 financial institutions ***

Bonds

The Bond Market traded on a slightly bullish note, due to a mini rally by some interested buyers who picked on offers on the longer end of the curve (34s – 37s). Yields on the long end consequently declined by c.12bps, with trades as low as 15.15% on the 2037s. There were also slight gains on the mid tenors (26s -28s) which compressed marginally by c.3bps.

We expect an imminent reversal to sentiments witnessed today, with the interests on the long end expected to wane in subsequent sessions. We also expect the mid tenors to remain favoured above the longer tenured bonds.

Treasury Bills

The T-bills market traded on a relatively quiet note, with yields ticking higher by c.20bps, despite the inflows from OMO T-bill maturities and the absence of an OMO auction by the CBN. This was as market players remained constrained by expectations for a retail FX debit and a possible OMO intervention by the CBN tomorrow.

We expect yields to close the week on a relatively flat note, unless the CBN fails to conduct an OMO auction, which would consequently result in resurgent buying interests, with a boost from FAAC payments expected tomorrow.

Money Market

The OBB and OVN rates crashed by c.11pct to 5.00% and 6.25% respectively, as inflows from OMO T-bill maturities (c.N261bn) bolstered system liquidity in absence of an OMO auction by the CBN.

We expect rates to close the week on a moderate tone, with inflows from FAAC payments (c.N350bn) expected to moderate outflows for the Retail FX auction tomorrow. This is however barring a significant OMO sale by the CBN.

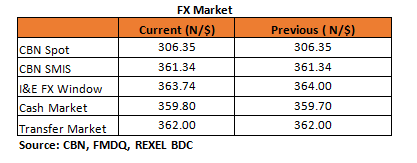

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.35/$ (spot) and N361.34/$ (SMIS). At the I&E FX window a total of $255.28mn was traded in 400 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate appreciated by c.0.07% to N363.74/$ from N364.00/$ previously.

At the parallel market, the cash rates depreciated further by 10k to N359.80/$, while the transfer rate remained unchanged at N362.00/$.

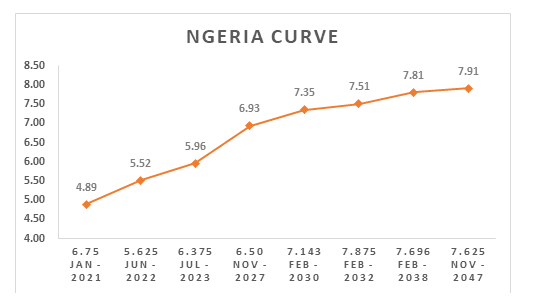

Eurobonds

The NGERIA Sovereigns remained significantly bullish as investors continued to cherry-pick across the curve in tune with the recent resurgent interests in EM and across the SSAs. Yields declined significantly by c.15bps across the curve, with the most gains seen on the 2047s which is now below the 8% mark, with a PX gain of c.1.20pct on the day.

The NGERIA Corps remained bullish, with investors firmly bullish on the FIDBAN 22s, following the positive results released recently by the bank. The ticker consequently posted a c.0.50pct PX gain on the day. We also witnessed renewed interest on the SEPLLN 23s which gained c.0.30pct, now trading 99.70/100.70.