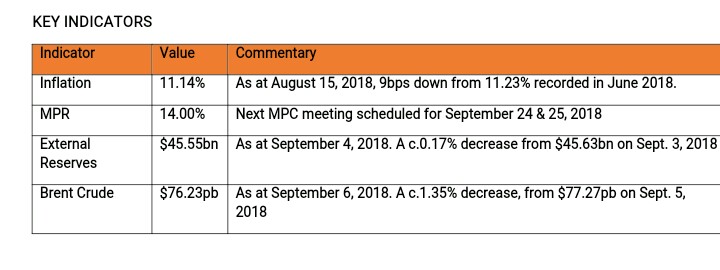

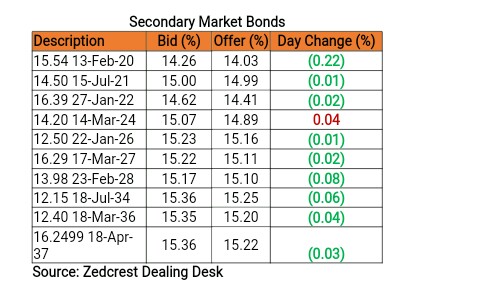

Bonds

The FGN bond market remained largely order driven in today’s trading session as Local Pension Funds and Asset managers continued to look for decent bargain on maturities with attractive yields. We witnessed significant trading activities mostly at the long-end, with more trading volumes skewed towards the 2036s & 2037s maturities. Consequently, yields across the curve compressed by c.5bps to close at 15.06% on the average.

We expect the market to trade cautiously tomorrow, with wide bid/offer spreads due to the recent yield increase on the longest offered OMO T-bills (182days) by the CBN.

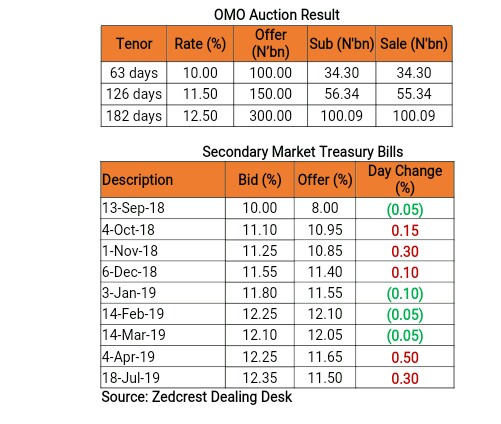

Treasury Bills

The T-bills market traded on a slightly bearish note today with most trading activities skewed towards the short end of the curve. The medium to long end of curve remained muted due to the floatation of another OMO auction by the Central Bank of Nigeria (CBN).

The Apex Bank floated another OMO auction today in a bid to mop up inflows from corresponding maturing OMO T-bills and lingering excess cash from FAAC disbursements. The CBN eventually succumbed to investor pressure for higher yields amidst weak subscription, raising the stop rate for the longest offered tenor (182days) to 12.50% (from 12.15% offered previously). A total of N137.59bn was sold across the 63-, 126- and 182-day maturities offered with stop rates printing at 10.00%. 11.50% and 12.50% respectively.

The shift in stop rates at the OMO auction will likely lead to bearish sentiments in T-bills market especially at the medium to long end of the curve. We expect a lethargic trading session tomorrow to wrap up for the week.

Money Market

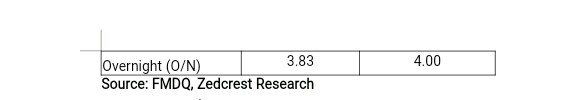

Interbank lending rates remained relatively stable, as the OBB and OVN closed at 3.00% and 3.83% respectively. System liquidity is estimated to close today at c.N600bn net positive after the sale of a total of N189.73bn at the OMO auction today which was not sufficient to offset corresponding inflows from N292.52bn OMO maturities.

We expect rates to close on a calm note, with no significant outflows expected closing the week. This is however barring another OMO auction by the CBN due to the high systemic liquidity.

FX Market

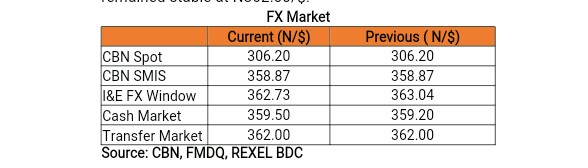

The Naira/USD rate traded stable at the interbank, closing at N306.20/$ (Unchanged DoD). At the I&E FX window, a total of $396.47mn was traded in 334 deals, with rates ranging between N353.00/$ – N364.50/$. The NAFEX closing rate appreciated by c.0.09% to N362.73/$ from N363.04/$ previously.

At the parallel market, the cash rate closed at N359.50/$ (c.0.08% lower), while the transfer rate remained stable at N362.00/$.

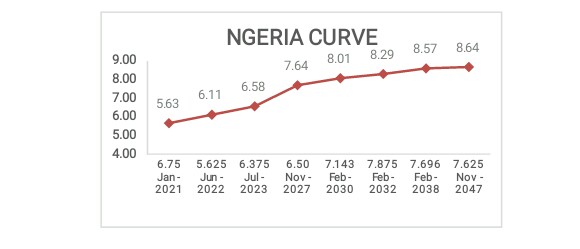

Eurobonds

The bearish sentiments on SSA sovereign bonds calmed today after being under attack since the start of the month, and the NGERIA Sovereigns saw better buyers on the day. Yields compressed by c.13bps, to close at 7.43% on the average across the curve.

The NGERIA Corps saw mixed trading sentiments at today’s session, as demand continued on the short-dated tickers while the longer-dated securities traded bearish. The GTBANK 18s gained 14bps DoD, while the FIDBAN 22s conversely lost 14bps DoD.