Weak EM sentiments persist as South Africa plunges into technical recession

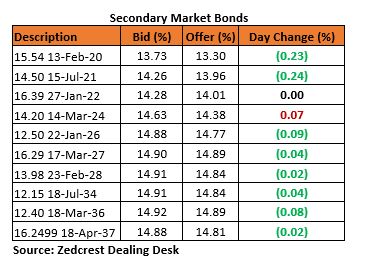

Bonds

The Bond market traded with mixed sentiments in today’s trading session, as the market which opened on a bearish note saw a reversal towards the close of trading. Bargain hunting by local clients dominated late trades across the mid-end of the curve, mostly on the 2027s. Yields consequently compressed by 4bps to close at 15.14% on the average across the curve.

We expect the market to be order driven with some client demand expected to take advantage of yields available on the mid- to long-end of the curve amidst buoyant system liquidity.

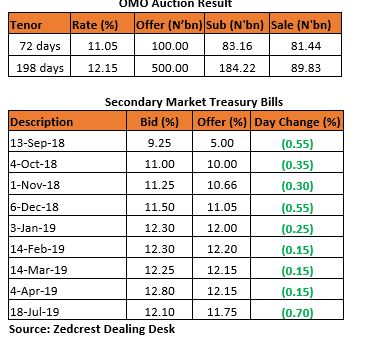

Treasury Bills

For the second consecutive trading session, yields in the T-bills market compressed by c.35bps as market players continue to invest excess liquidity in the secondary market.

The CBN floated an OMO auction today, offering a total of N600bn over two maturities. Despite weak demand at the auction, the Apex bank defied expectations for an increase and maintained stop rates at 11.05% and 12.15% for the 77- & 198-day maturities respectively.

With OMO maturities expected later in the week, the CBN is likely to float another auction to manage system liquidity. We expect market participants to remain active at the short-end of the curve as investors continue to test the CBN’s resolve to keep rates stable at subsequent OMO auctions.

Money Market

The OBB and OVN rates declined further to close at 3.08% and 3.92% respectively, as System liquidity is estimated to close today at c.N623.60bn due to inflows from FAAC payments to States and LGAs.

The CBN sold a total of N171.27bn at an OMO auction today in a bid to manage the excess liquidity.

We expect rates to remain relatively stable due to the significantly buoyant level of system liquidity.

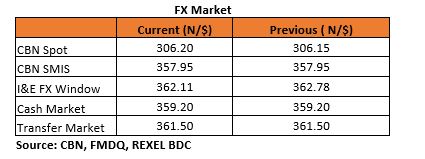

FX Market

The Naira/USD rate showed slight depreciation at the interbank, closing at N306.20/$ (0.02% lower DoD). At the I&E FX window, a total of $174.25mn was traded in 395 deals, with rates ranging between N359.00/$ – N364.00/$. The NAFEX reference rate appreciated by 0.19% to N362.11/$ from N362.78/$ previously.

At the parallel market, both cash and transfer rates remained stable at N359.20/$ and N361.50/$ respectively.

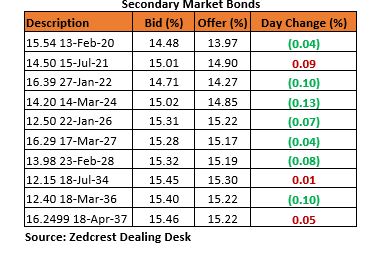

Eurobonds

The markets resumed from the Labor Day holiday on a bearish note, a weakness across the sub-Saharan African markets following the general EM sell-off continue to pressure the NGERIA Sovereigns. Yields consequently ticked c.20bps higher, to close at 7.47% on the average across the curve.

The NGERIA Corps trade mixed during today’s session, as investors cherry picked securities. Demand interest were witnessed on GRTBNL 18s, DIAMBK 19s and FIDBAN 22s, while investors sold off the SEPPLN 23s.