*** Nigerian Eurobonds Turn Bearish Amid Emerging Market Selloff, Trade Tensions***

Bonds

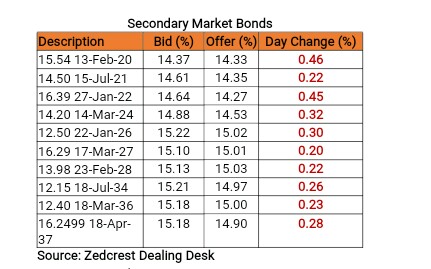

Bond Yields spiked by c.30bps in today’s session, as market players reacted to the hike in PMA rates by the DMO in the previous session. Yields on the mid to the long end of the curve consequently breached the 15% mark, with selloffs most notable on the 2034s which traded as high as 15.21%. We also witnessed significant selloffs on the shorter end of the curve (mostly on the 2020s) where yields rose by c.45bps. Bond yields at an average of 14.95%, have now hit record high levels last seen in the month of Nov 2017 before the issuance of Eurobonds by the DMO for T-bills refinancing.

The CBN issued a no sale result at today’s OMO auction, resisting pressures to hike rates in response to recent market developments. Despite this, our outlook remains bearish in tune with continued weakness in Emerging markets, and expectations of further uptrend in yields, with the CBN also expected to cave into the bearish market pressures sooner or later.

Treasury Bills

Yields in the T-bills market spiked by c.100bps, with significant widening in bid-offer spreads across the curve. This came as market players repriced quotes in reaction to developments at the previous day’s auction. Trading activities were however relatively muted, as market players cautiously anticipated results from the CBN OMO auction which were not released until close of trading.

With most market players placing bids at c.13% at today’s auction, the CBN issued a No-Sale OMO result. This is expected to slightly moderate bearish market sentiments, with trading activities expected to remain relatively constrained to the short end of the curve, as market players seek for more clarity on CBN action with respect to its clearing rates for OMO Auctions.

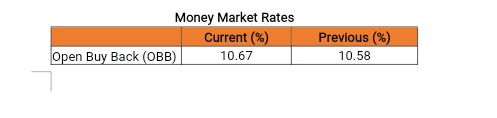

Money Market

The OBB and OVN rates remained relatively unchanged, closing today at 10.67% and 11.67% respectively. With inflows from OMO maturities and retail FX refunds today, system liquidity is estimated to have improved to c.N400bn from c.N100bn previously.

Barring a further OMO Auction, we expect rates to remain relatively stable, with the rise in system liquidity expected to support outflows for retail FX funding by banks tomorrow.

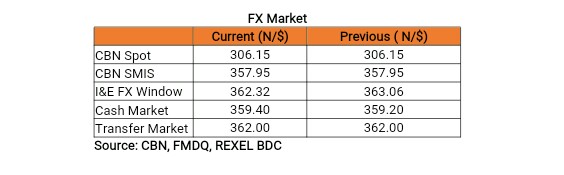

FX Market

The Naira/USD rate remained stable at the interbank, closing at N306.15/$. At the I&E FX window, a total of $252.66mn was traded in 25 deals, with rates ranging between N357.00/$ – N363.80/$. The NAFEX reference rate appreciated by 0.20% to N362.32/$ from N363.06/$ previously.

At the parallel market, the cash rates depreciated by 20k to N359.40/$, while transfer rates remained unchanged at N362.00/$.

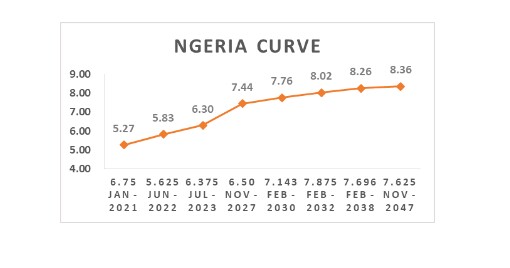

Eurobonds

The NGERIA Sovereigns turned bearish in today’s session with yields rising by c.8bps, as investors sold off on emerging market assets, on the back of the continued trade spat between the US and China, and amid turmoil in Argentina and Turkey. The most selloff on the NGERIA Sovs was seen on the 30-yr which lost -0.90pct on the day.

The NGERIA Corps were relatively muted, except for slight interests witnessed on the DIAMBK 19s, ACCESS 21s and UBANL 22s.