Nigeria, UK sign agreements on security, economic devt

Bonds

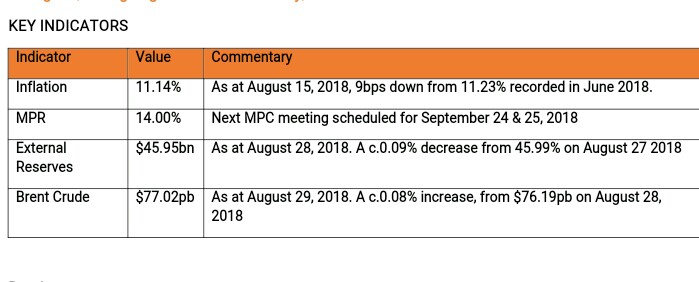

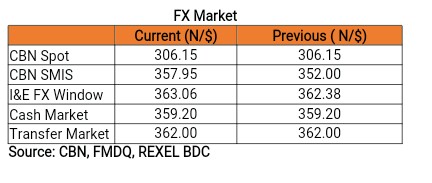

The Bond Market remained relatively calm in today’s session, with yields ticking slightly higher by c.3bps, following slight sell on some of the preferred bonds in the previous session. Market players have so far maintained a moderately risk off bias after the earlier spike in yields that proceeded the recent Turkish and broader emerging market selloffs.

Going forward, we expect yields to break above our earlier stated resistance of 15%, on the back of the recent actions by the DMO at today’s PMA, where yields on the 1-yr bill were cleared at c.15% (effect. Yield). This sentiment should however be moderated, if the CBN retains rates at the OMO auction expected tomorrow.

Treasury Bills

Yields in the T-bills market compressed by c.20bps in today’s session, with most trades observed on the shorter end of the curve. This came as market players flowed some demand into the secondary market, as the PMA rates were expected to clear below secondary market levels, especially on the 91- and 182-day tenors.

The PMA results however came as a shock, with the DMO raising the total amount offered (c.N207bn) at c.160bps above their previous auction levels. The 364-day cleared significantly above their current market levels at 13.05%, while the 91- and 182-day cleared around their secondary Market (OMO) levels at 11.00% and 12.30% respectively.

We expect the market to be intensely bearish in tomorrow’s session, as market players react to this relatively unexpected turn of events. As stated earlier, selloffs would be moderated if the CBN holds rates at the OMO auction tomorrow.

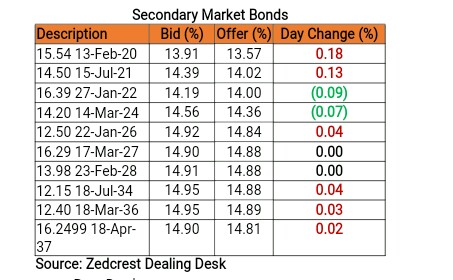

Money Market

The OBB and OVN rates inched slightly higher to close at 10.58% and 11.75% respectively. This is coming on the backdrop of a continued decline in the net system liquidity figure, down to c.N160bn in published opening figures. The decline in system liquidity could be attributed to the persistent interventions by the CBN in various segments of the FX markets, in a bid to sustain the stability of the Naira amid decline in offshore inflows.

We expect rates to trend slightly lower tomorrow, with inflows from OMO maturities and retail FX refunds expected to bolster system liquidity. No news yet on FAAC.

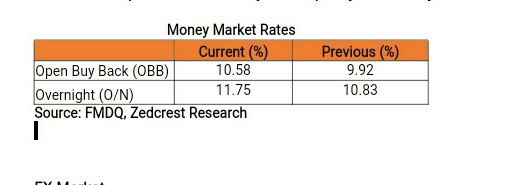

FX Market

The Naira/USD rate remained stable at the interbank, closing at N306.15/$. At the I&E FX window, a total of $131.82mn was traded in 258 deals, with rates ranging between N358.00/$ – N364.00/$. The NAFEX reference rate depreciated by 0.19%, hitting a new high of N363.06/$ from N362.38/$ previously.

At the parallel market, the cash and transfer rates remained unchanged at N359.20/$ and N362.00/$ respectively.

Eurobonds

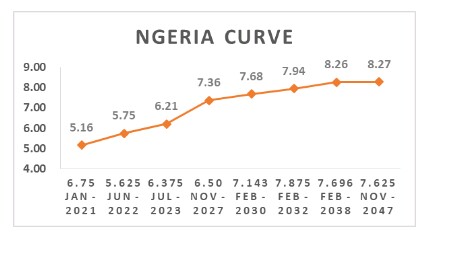

The NGERIA Sovereigns traded on a relatively calm note, as yields remained flat across the curve. We only witnessed slight selloff on the 2023s which ticked higher by a single basis point.

The NGERIA Corps were also relatively muted, except for slight interests witnessed on the DIAMBK 19s, ZENITH and FIDBAN 22s.