Nigeria’s GDP grows by 1.5% in Q2 2018 – NBS

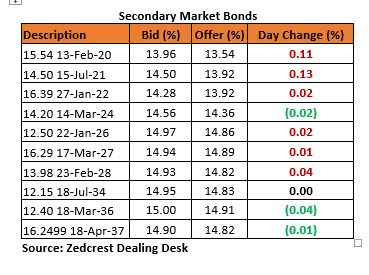

Bonds

The Bond market opened the week on a relatively quiet note, with scanty trades observed on the mid to long end of the curve. Market players showed more preference for the longer tenured bonds, while yields on the short and medium tenured bonds tracked slightly higher due to the relatively weaker demand in those segments. Yields consequently closed at c.3bps higher across the curve.

We expect yields to remain relatively stable in the near term, but with the broader market sentiment expected to lean towards a slightly more bearish outlook, due to slower than expected GDP growth and weaker capital importation figures in Q2 2018.

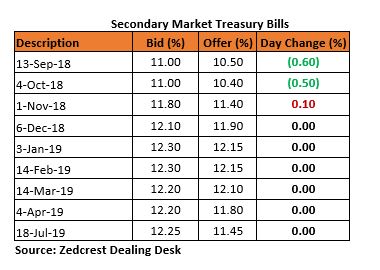

Treasury Bills

The T-bills market was also relatively quiet, but with further downtrend in yields observed on the shorter end of the curve (<90days), as market players maintained risk averse sentiment, with expectations of higher yields on T-bills as we approach year end. Yields on the mid to long end remained flat, with no significant demand observed in those segments.

We expect yields to remain slightly pressured, due to relatively weak client demand, and sustained OMO interventions by the CBN.

Money Market

The OBB and OVN rates rose above its long sustained single digit levels, closing today at 12.83% and 13.92% respectively. This was likely due to outflows for a wholesale FX funding by banks, which is estimated to have compressed the net system liquidity below N300bn.

Rates are expected to trend lower in subsequent sessions, with inflows from OMO maturities and FAAC payments expected before week end.

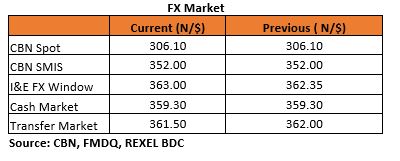

FX Market

The Naira/USD rate remained unchanged at the interbank, closing at N306.10/$. At the I&E FX window, a total of $431.39mn was traded in 425 deals, with rates ranging between N330.00/$ – N364.00/$. The NAFEX reference rate depreciated by 0.18%, hitting a 12-Month high of N363.00/$.

At the parallel market, the cash rates remained unchanged at N359.30/$, while transfer rates appreciated by 50k to N361.50/$.

Eurobonds

The NGERIA Sovereigns were flat for the day, with no significant trading observed on the back of the bank holiday in the UK.

The NGERIA Corps were also relatively muted, except for slight interests seen on the ZENITH and FIDBAN 22s.