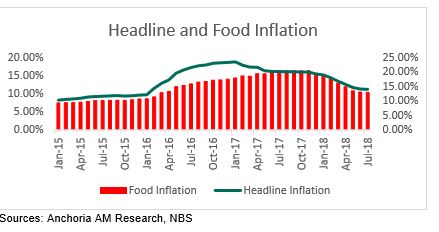

The headline inflation is at 11.14% year-on-year (YoY), this represents a decline of 0.09% from the previous rate of 11.23% YoY, making it the eighteenth consecutive decline in headline inflation since January 2017. This is driven by a decline in the food inflation. Consequently, the food inflation stood at 12.85% (year-on-year) in July, down from the 12.98% recorded in June 2018.

On a Month-on-Month basis, there is a reversal in the trend of inflation rate as the headline inflation fell from 1.24% MoM in June to 1.13% MoM in July. This is due to the uptick in the food inflation rate witnessed in June as a result of Ramadan Period, which moderated in July after Ramadan season. Also, in line with Food and Agriculture Organisation’s (FAO) Food Price Index Report for July 2018, prices of imported food fell to 0.70% from 1.22% in June due to weaker export quotation for Wheat, Maize and Rice.

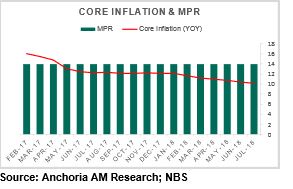

Core Inflation moderates in July below Monetary Policy Rate (MPR) by a wide Margin

Core inflation moderates to 10.18% in July from 10.39% in June 2018. This is lower than the MPR of 14.00%. However, in July the Average Bond Yield is above the core inflation which connotes an increasing return on investment. The average yield for 5 years Bond (13.81%); 10 years Bond (14.06%) and 20 years Bond (14.20%). Also, the 91-days Treasury Bill primary market yield of 10.26% is slightly above the core inflation rate

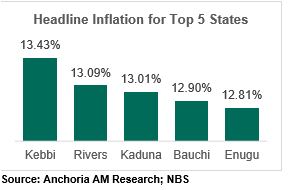

Kebbi State: The Land of Equity tops the chart with a 13.43% Headline Inflation rate

In July 2018, headline inflation on a year-on-year basis was highest in Kebbi (13.43%), Rivers (13.09%), Kaduna (13.01%), Bauchi (12.90%) and Enugu (12.81%) while Plateau (8.82%), Ogun (8.86%), Kwara (9.63%), Sokoto (9.72%) and Delta (10.06%) recorded the lowest rate in headline inflation. Headline inflation on a year-on-year in commercial cities of Lagos and Abuja rose to 11.75%, 12.61% respectively while that of Kano fell to 10.09%.

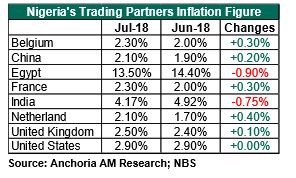

Nigeria’s Trading Partners Inflation Figure

Based on selected inflation reports of some of the country’s trade partners, we observed an increase in inflation rate for most, except for Egypt and India that witnessed reduction in inflation rate. USA inflation rate remained unchanged.

Our Outlook for August Inflation Report

We expect a slight reverse in the downward trend of the inflation rate on a year-on-year basis in August 2018 due to:

- Increased haulage cost by 900% by Road Transport Employer Association of Nigeria, which we expect to be passed to the final consumer through increase in imported goods.

- Increased system liquidity as two months Federal Government Allocation (FAAC Inflow) hits the system late July 2018.

Click here to download the full report from NBS.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com