Funding Rates Tick Higher as Banks Fund for CBN SMIS

CBN’s intervention reaches 400,000 farmers

KEY INDICATORS

Bonds

The Bond market opened the week on a flat note, with only a total of c.N700m in market trades done on the 28s, 34s and 36s. We witnessed slight buys on the 2036s, but with some pullback on the 2028s. Yields consequently closed flat on average.

Market trend is expected to remain flattish, barring a renewed selloff from offshore clients, especially on the 2027s.

Treasury Bills

The T-bills market traded on a relatively flat note, with only slight demand seen on the Jan-Feb maturities, while yields inched slightly higher on the shorter tenured bills. Yields consequently compressed marginally by c.2bps to c.11.78% on average.

We expect yields to maintain a slightly downward trend, as market players anticipate inflows (c.N452bn) from OMO T-bills maturities on Thursday, coupled with the relatively buoyant level of System Liquidity at c.N270bn positive.

Money Market

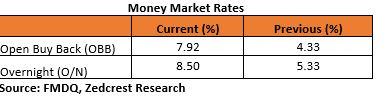

The OBB and OVN rates opened the week higher, closing today at 7.92% and 8.50% respectively. This came on the back of a slight squeeze in system liquidity due to a Wholesale FX provisioning by banks. System liquidity is consequently estimated to have compressed by c.N70bn from c.N340bn opening today.

We expect rates to remain stable tomorrow, due to the relatively buoyant level of liquidity in the system.

FX Market

The Naira depreciated by 0.02% to an upper band of N306.00/$ at the interbank market. It however appreciated by 0.20% at the I&E FX window, closing at N361.96/$ (from N362.67/$ previously). At the parallel market, the cash and transfer market rates fell back by 10k and 50k to N358.50/$ and N361.50/$ respectively, while the CBN sustained its interventions in the Wholesale and BDC segments of the FX market.

Oil prices rose slightly higher today, with Brent crude futures strengthening further to c.$73.92pb, as market players anticipate a tighter Oil market in the coming months. The CBN’s External reserves has however maintained a steady decline, down to $47.01bn as at 3-Aug, from c.47.09bn on the 2nd of August.

Eurobonds

The NGERIA Sovereigns traded on a relatively flat note, with slight interests seen on the shorter end of the curve (2023s). Yields consequently compressed by c.2bps on average.

Activities in the NGERIA Corps were also relatively muted, with few interests seen on the GRTBNL 18s, while investors were slightly bearish on the DIAMBK 19s.