Bond Yields Compress following Demand on the Mid Tenor Bonds

NBS to Publish Q2 GDP Report on Monday

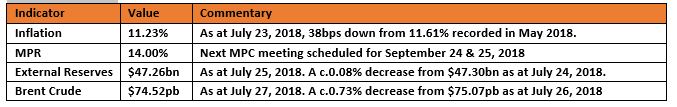

KEY INDICATORS

Bonds

The Bond market closed the week on a slightly more active note, with spreads getting tighter across the curve. This came on the back of some demand especially on the mid tenured bonds (27s & 28s) which compressed yields by c.17bps, consequently reversing some of the losses from the previous session. Bond coupon payments totaling c.N50bn were paid to holders of the Jan-2022 maturity and this is believed to have supported some of the bullish sentiments, with clients opting for more of the higher coupon bonds.

In the coming week, we expect the market to be largely order driven, but with yields expected to track slightly higher in line with the general weakness in the broader market sentiment. The NBS is expected to release the Q2 GDP report on Monday, our expectations are for a slower rate of growth which adds to our slightly bearish outlook.

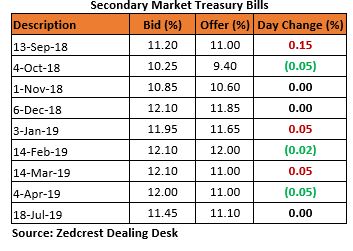

Treasury Bills

Activities in the T-bills market were mixed, with some sell on the short end and slight demand for the longer tenured bills. Yields consequently tracked higher by c.5bps on average. We witnessed the most selloff on the 31-Jan (+25bps), while market players were mostly bullish on the 21-Mar (-70bps).

In the Coming week, the CBN will conduct an NTB Auction on Wednesday to rollover c.N207bn PMA maturities. There is also c.N324bn OMO T-bills maturing on Thursday. In line with our expectations for a continued moderation in system liquidity by the CBN, we expect yields in the Secondary market to remain relatively stable over the course of the week.

Money Market

The OBB and OVN rates declined slightly to close the week at 6.83% and 7.25% respectively, as system liquidity was bolstered by c.N50bn inflows from bond coupon payments which partially offset system outflows for today’s bond auction settlement. System liquidity is consequently estimated to close be unchanged at c.250bn positive.

In the coming week, rates are expected to trend higher over the course of the week, in tune with expectations for increased liquidity outflows via expected OMO and FX (wholesale/Retail) interventions by the CBN.

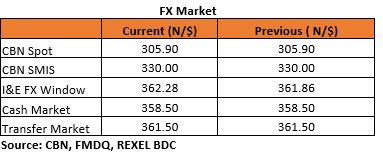

FX Market

The Naira remained stable at N305.90/$ in the Inter-bank market, whilst depreciating further by 0.12% to N362.28/$ at the I&E window. The Parallel market rates remained flat, closing at N358.50/$ and N361.50/$ at the Cash and transfer market segments respectively.

Eurobonds

The Nigerian Sovereigns were slightly bullish, with yields compressing by c.4bps across the curve. The most interests were still on the 2047s, which gained about 0.50pct d/d.

Investors were also slightly bullish on the Nigerian Corporates, with most interest seen on the SEPLLN 23s which gained about 0.50pct on the day.