The Cordros Asset Management recently launched what could be called Nigeria’s first target date funds and the media went agog with the news.

This is not only innovative, but it has also added to the number and variety of financial products available to Nigerians for personal financial and retirement planning. It will not be surprising if other fund managers follow the footsteps of Cordros Asset management in launching target date funds anytime soon. Like anything innovative and new, I am sure that the news of this new financial product comes with curiosity and excitement, but this piece is aimed at dealing with the former.

About Target Date Funds

Though target date funds are new in Nigeria, they are not new in more developed financial markets like those of America. Infact, Barclays Global Investors launched the first Target date fund in the US in the 1990s as a financial product that would help parents save for their children’s expected college expenses. Then, investors would select target date funds that would mature or end on the dates that they expected their children to enroll in the university or college. Thereafter, target date funds became financial products that could be used to plan and fund for any future event. However, they are used more today for retirement planning purposes than any other event and the target date has become almost synonymous with the date when an investor plans to retire.

Target date funds are therefore retirement mutual funds that allocate assets according to investors’ retirement period. Over time, the fund manager rebalances the fund so that it becomes more conservative, with less and less equities and more and more fixed income securities as investors move closer and closer to retirement.

This means that the asset allocation mix of target date funds provide exposure to high risk high return assets, like equities, in the early years of the fund and the investor, when such investors are presumed to still have a higher capacity for risk. As such capacity for risk decreases with age and passage of time, the asset allocation mix is gradually but incrementally tilted towards more conservative assets, like fixed income securities.

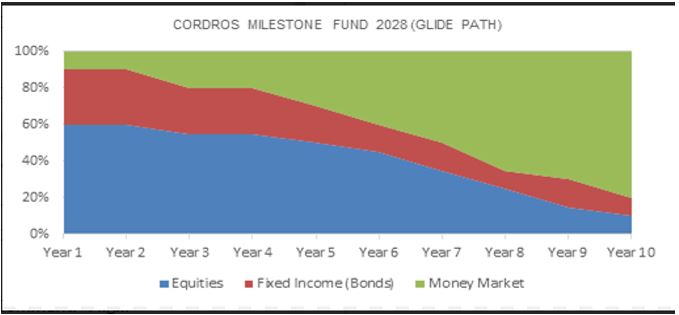

In that case, exposure and fund objective is progressively moved from capital appreciation to capital preservation. The route that the process of moving assets through time from more risky assets to more conservative assets takes is called “glide path”.

Understand the Glide Path

Before you invest in a target date fund, understand the glide path. A glide path shows the gradual change in investment mix as time changes. A typical glide path is divided into three parts, accumulation stage which falls from 20 to 45 years prior to retirement, Transition stage that happens between target date to 15 years before retirement, and Distribution, that is from target date until death.

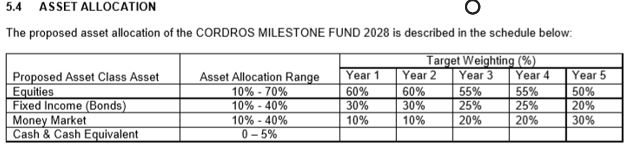

Most glide paths come in picture, but some are accompanied with a table that shows the asset allocation mix for each year until target date.

Know your Event Date

Before investing in or choosing a Target date fund, you should know the date of the event for which you want to save or invest. If you are aged 25, and you plan to retire at 55, a target date fund dated 15 years from now is not suitable for you, rather a target date fund that is targeted 30 years afar is most likely what you need.

Know What Happens After Target Date

Target date funds are classified as “to” or “through” glide path. This classification helps explain what happens to a target date fund after the target date. Target date funds managed to the target date, (retirement) freeze the asset allocation mix at the target date.

Meaning that after the target date, the asset allocation mix ceases to change but target date funds that are managed “through” retirement or target date continue to adjust the asset mix by decreasing the allocation to equities for years after the target date. When choosing a target date fund, find out whether the asset allocation mix will continue to be changed after the target date or it will be fixed upon reaching the target date.

This is especially important if you are using the target date fund to save for retirement. “To” glide path structured target date funds tend to be slightly less risky during retirement periods than “through” target date funds whose asset allocation mix continues to change. However, the disadvantage is that, through glide path structure helps offset inflation and may provide further growth potential during retirement.

Know the Equity Landing Point of the Fund

Every target date fund must have an equity landing point, which is the point at which the target date fund reaches its lowest equity allocation. This differs from fund to fund and there is no right or wrong landing point. When you know the equity landing point, it will help you gauge the risk profile of the fund as it approaches target date.

While the above are by no means exhaustive of what you need to know, it is hoped that it will help you choose among target date funds, get ready because they are coming very soon.