Funding Rates Rise Back to Double Digits as Banks fund for Retail FX

Active Mobile Telephone Lines in Nigeria Hit 162m- NCC

Bonds

The bond market remained relatively flat with most activities still on the 2036s. We however witnessed slight buy interests on the 2037s which compressed yields marginally by a single basis point. We expect the market to remain relatively stable in the near term, as market players have shown renewed buying interests at current levels. Our forward expectation for yields however remains slightly bearish due to continued EM selloffs, slightly higher year end inflation expectations and expected increase in the level of FGN borrowings.

Treasury Bills

The T-bills market traded on a firmly bullish note, with yields declining by c.30bps on average. This came on the back of excess inflows from T-bill maturities in the previous session, which spurred some buying interests in the market. We expect the market to remain slightly bullish as we anticipate that a resolution of the recent FAAC standoff in the coming week would further moderate liquidity pressures in the system. This is however barring a renewal of OMO auctions by the CBN.

Money Market

The OBB and OVN rates rose higher by c.7pct to 11.33% and 12.92% respectively. This came on the back of a squeeze in system liquidity, as banks had to fund for their FX bids at a Retail Auction by the CBN today. System Liquidity is consequently estimated to close at c.N200bn, as outflows for the retail FX sales (N300bn est) were slightly moderated by inflows from refunds of the last auction (N100bn est). We expect rates to remain slightly pressured on Monday, as banks are expected to fund for another round of FX sales in the Wholesale Market.

FX Market

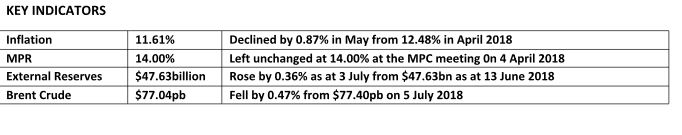

The Interbank rate remained stable at its previous rate of N305.70/$, with the CBN’s external reserves recorded to have improved by 0.36% to $47.80bn from $47.63bn on the 13th of June. The NAFEX rate depreciated further by 0.09% to another high of N362.58/$, last seen on 14-Aug-17, where market closed at N362.50/$. The total volume traded however rose slightly higher by 22% to $179m. In the parallel market, cash rates appreciated by 40k to N359.00/$, while the transfer market rate remained stable at N363.50/$.

Eurobonds:

The NGERIA Sovereigns remained firmly bullish, with yields declining further by c.16bps on average, consequently capping a 34bps W-o-W decline in what has been a largely positive week for the NGERIA SOVs. The Shorter tenured bonds (21s & 23s) were the highest gainers of the week with their yields declining significantly by c.40bps, as investors preferred to stay short of duration risk on the longer end of the curve.

The NGERIA Corps were relatively flat, except for slight buying interests on the ACCESS 21s (Sub) and UBANL 22s, and slight sell off on the GRTBNL 18s which rose by c.25bps.