CBN Holds Off on OMO as Interbank SLF hits 5-Week High

World Bank Approves $2.1bn Project Support Loan for Nigeria

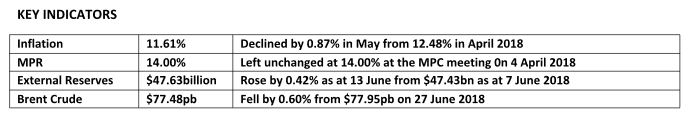

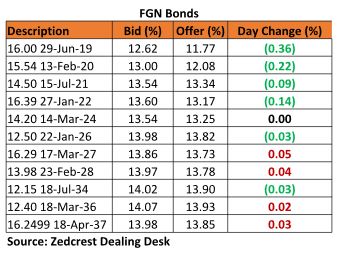

Bonds

The Bond market traded on a relatively mixed note, with some demand witnessed on the short end of the curve and slight sell on the medium to long end. Yields consequently compressed by c.7bps on average. We expect a relatively quiet trading session tomorrow, as market players wind up activities for the half year.

Treasury Bills

Yields trended slightly higher in the T-bills space with some selloff witnessed on the short end of the curve as some market players were looking to generate liquidity for their month end cash positions. We also note that the CBN did not conduct an OMO auction in today’s session. This was in a bid to ease liquidity pressures in the system, as banks’ borrowings at the SLF hit a month to date high of N137bn in the previous session. We expect yields to remain relatively flat tomorrow, as a delay in FAAC disbursement means inflows may not hit the system as soon as expected.

Money Market

The OBB and OVN rates declined significantly to 14.50% and 15.25% respectively. This came on the back of inflows (c.N183bn) from OMO maturities which helped moderate funding pressures in the system. System liquidity is consequently estimated at c.N190bn on the back of the OMO inflows. We expect rates to remain relatively stable at these levels, barring a significant debit from the system by the CBN.

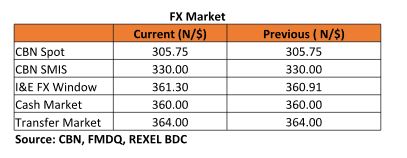

FX Market

The Interbank rate remained stable at its previous rate of N305.75/$. The I&E FX rate fell back by 0.11% to N361.30/$. In the parallel market, cash and transfer rates remained stable at N360.00/$ and N364.00/$ respectively.

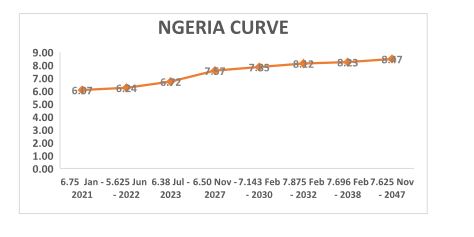

Eurobonds:

The NGERIA Sovereigns traded on a slightly bearish note with yields ticking higher by c.2bps on average. We witnessed the most selloff on the 30s and 38s which fell by –0.50pt. We however witnessed sight buy interests on the Jan 21s which gained +0.15pt.

The NGERIA Corps were relatively mixed, with investors cherry-picking on the ZENITH 19s and 22s, while we witnessed slight sell on the DIAMBK 19s. Investors also picked on some ACCESS and FBNNL 21s.