Investors Remain Bearish on Nigerian Eurobonds ahead of Expected US Rate Hike

CBN to offer N181bn T-bills at PMA Tomorrow

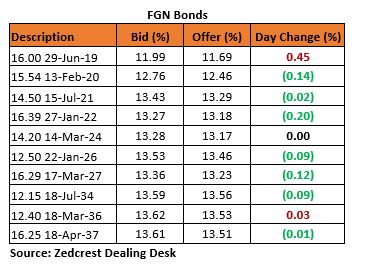

Bonds

Bond yields moderated slightly with some buys mostly on the 2034s taking yields lower by c.2bps on average. We also witnessed significant client interests on the 2027s /2028s, consequently compressing the 10-yr yield by c.10bps. We expect a slowdown in buying sentiments as market players are expected to maintain a relatively risk-off sentiment in anticipation of an expected hike in the US FED fund rates by the FOMC tomorrow.

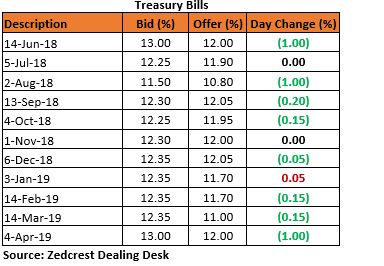

Treasury Bills

The T-bills market trade on a relatively quiet note, with yields compressing slightly by c.5bps on average, following slight buys on the Jun, Sep, and Dec maturities. We expect another quiet trading session tomorrow, (with some continued demand however on the Sep & Dec maturities), as market players shift focus to the primary market Auction, where rates are expected to clear slightly above their previous levels, due to the increased volumes on offer (c.N181bn).

Money Market

The OBB and OVN rates rose higher by c.4pct to 15.17% and 16.50% as system liquidity remained slightly pressured at c.N150bn positive. We expect rates to remain slightly elevated at these levels, as there are no significant inflows expected into the system until Thursday when we have c.N244bn OMO T-bill maturities.

FX Market

The Interbank rate remained stable at its previous rate of N305.90/$. The I&E FX rate reversed recent gains, depreciating by 0.12% to N361.30/$. In the parallel market, cash rates depreciated further by 20k to N361.50/$, while the transfer market rate remained stable at N364.00/$.

Eurobonds:

The NGERIA Sovereigns remained significantly bearish, as investors continued selling off across the curve ahead of the much-anticipated hike in the Fed funds rate tomorrow. Yields consequently rose by c.10bps on average, with the most selloff seen on the 2027s and 2047s which were down by more than 1pt.

The NGERIA Corps also remained bearish across all traced tickers, with the most selloff witnessed on the Access 21s Snr which fell by as much as -0.85pt (+28bps).

Investors also sold off on the Zenith 22s (-0.50pt), UBANL 22s (-0.20pt) and FBNL 21s (-0.20pt).