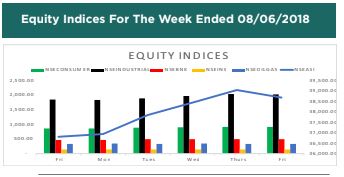

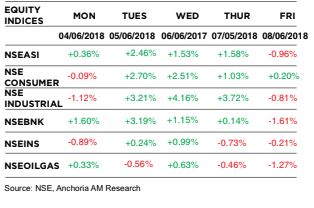

The performance of the Nigerian Equity Market was largely bullish last week with the index (NSE ASI) up by 5.03% WTD to close at an index level of 38,669.23 and market capitalization of N14.01 trillion.

The sectoral performance was positive as bullish sentiments were witnessed in all sector with the exception of Insurance and Oil & Gas index that slipped by 0.61% and 1.34% respectively. The Industrial sector recorded the highest gain amongst NSE indices with the NSE Industrial Goods index up by 9.36% WTD, owing to significant price appreciation in WAPCO (+17.06%) and DANGCEM (+5.74%).

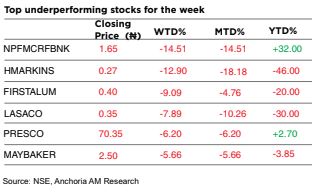

The market activities were characterised by bargain hunting on 4 out of the 5 trading sessions last week. This is due to increased investors’ interest to take advantage of the low and attractive prices of some stocks.

In the global space, there were mixed reactions in the stock markets during the week. The bullish sentiment continued in the US market as investors ignored trade tension as leaders of the group of seven industrialised (G-7) nations met in Canada during the week.

However, UK and some European bourses fell as tension increased ahead of the G-7 meeting.

Stock Watch

Over the last five trading sessions:

FBNH (FBN Holdings) rose by 3.94% to close at N10.55. We maintain a hold rating on this stock.

GUARANTY (Guaranty Trust Bank) rose by 6.46% to close at N41.15. We maintain a sell rating on this stock.

ZENITHBANK (Zenith Bank) rose by 6.08% to close at N27.05. We maintain a sell rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com