Weekly market breadth negative at 0.23x

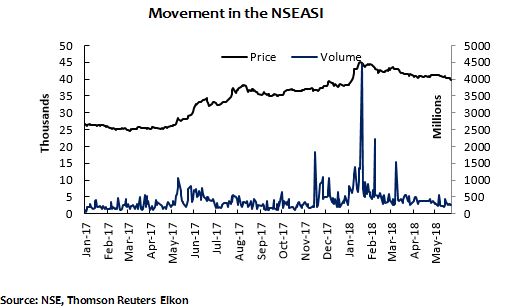

- The NSEASI-2.84% closed underwater at the end of the week, following the selling pressures witnessed across sectors. Accordingly, the YtD return on the bourse closed lower at 2.83%.

- The weekly market breadth closed negative at 0.23x with 13 gainers and 56 losers. Similarly, total market cap declined to NGN14.24trn. MRS+21.18% topped the weekly gainers’ chart while ETERNA-22.27% was the top loser.

- All sectors reflected the current negative market sentiment. The NSE banking index pared the most after losing 22.47 points in the week. The NSE consumer goods index trailed closely, shedding 3.62% week on week.

Why stocks are down

- The bourse remained in the red after recording losses on all trading sessions this week.

- However, counters such as; MRS+21.18%, LAWUNION+20.99%, and NIGERINS+19.05% recorded healthy gains in the same period.

- We expect the current trend to be maintained in the coming week.

Banking Sector: Negative momentum intensifies

Selling pressures heightened as no counter in this space recorded gains week on week.

Investors were most bearish on FCMB which pared 15.38% to close at NGN2.20.

The least sell-off was witnessed on ETI-0.49% which recorded a downtick in the week to close at NGN20.50.

The YtD return on the NSEBNK10 index settled at +3.20%.

Industrial Goods Sector: WAPCO+0.62% tops the gainers’ chart

Positive sentiments returned to WAPCO during the week, causing the counter to close as the sole gainer in the sector.

Other counters closed in the negative territory with CUTIX-4.76% topping the sectors’ weekly laggards’ chart.

The YtD return on the NSEIND settled lower at +4.22%.

Contact Morgan Capital for more information. Email: info@morgancapitalgroup.com

www.morgancapitalgroup.com